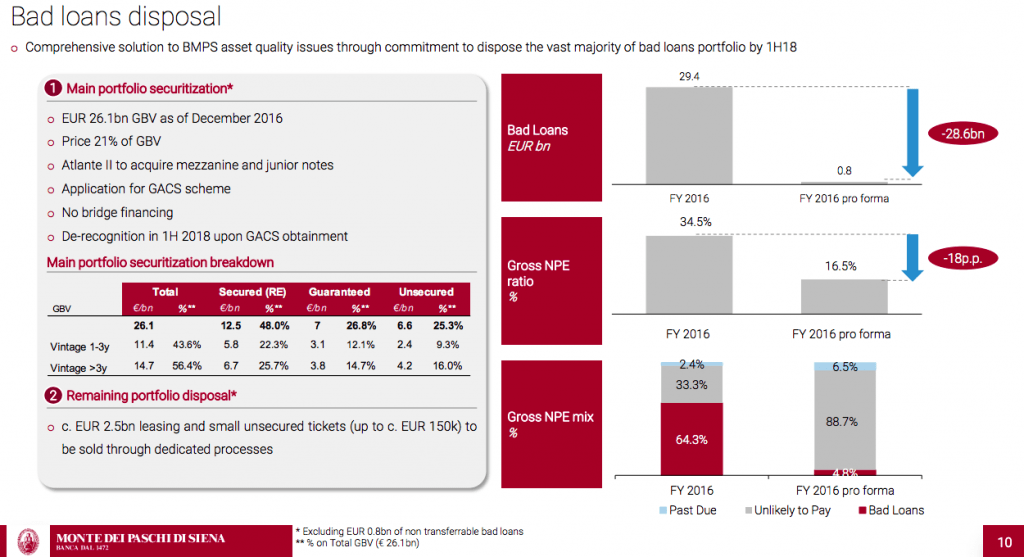

Montepaschi Group completed yesterday the securitization process for a bad loan portfolio that on September 30th 2017 was worth 24.07 billion euros (see here the press release ) or about 2 billions below the 26.1 billions figure calculated at the end of 2016 and reported last July, after the EU Commission gave its go-ahead to the Restructuring plan 2017-2021 (see here the press release and the analysts’ presentation).

Montepaschi Group completed yesterday the securitization process for a bad loan portfolio that on September 30th 2017 was worth 24.07 billion euros (see here the press release ) or about 2 billions below the 26.1 billions figure calculated at the end of 2016 and reported last July, after the EU Commission gave its go-ahead to the Restructuring plan 2017-2021 (see here the press release and the analysts’ presentation).

More in detail, spv Siena NPL 2018 srl bought the portfolio last December 2017 (see here the announcement in Italy’s Official Journal) and issued different tranches of notes that were restructured in the last few days as the following:

- Senior notes for 2.918 billion euros, which have been assigned an A3/BBB+/BBB rating by Moody’s Investors Service, Scope Ratings GmbH and DBRS Ratings Limited, respectively (see here Moody’s report)..The notes, which will be assisted by GACS, will be initially retained by BMPS, which may subsequently consider their partial placement on the market. The senior notes’ tranching exceeds Restructuring Plan expectations, which contemplated a class of Non-Investment Grade notes for approximately 500 million euros that will therefore not be issued. The notes will pay a euribor 3m plus 150 bps coupon, including in their structure the premium due to the Italian Ministry of Economy and Finance (MEF) for the guarantee provided on the notes.

- Mezzanine notes for 847.6 millions, unrated, which were sold on 22 December 2017 to the Italian Recovery Fund managed by Quaestio Capital sgr (see here a previous post by BeBeez).

- Junior notes for 565 millions, unrated, which will be sold to the Italian Recovery Fund.

Gacs guarantees on senior notes are expected to be obtained over the coming weeks whereas the deconsolidation of the bad loan portfolio is expected by June 2018, following the transfer of the junior notes to the Italian Recovery Fund. As for the Gcas,the Italian Ministry of Economy and Finance asked the EU Commission for a new 6 months postponement of their deadline (see here Ansa). Gacs was initially built in February 2016 and was due to last 18 months. Their deadline was then postponed for other 12 months with the new deadline next September.

Coming back to the Mps’ deal, the securitization was structured by MPS Capital Services, Deutsche Bank, Mediobanca Banca di Credito Finanziario and JP Morgan as Lead Arrangers and by HSBC and Crédit Suisse as co-Arrangers. MPS Capital Services, Deutsche Bank, Mediobanca Banca di Credito Finanziario, JP Morgan, HSBC and Crédit Suisse will act as Placement Agents.

BMPS has appointed Credito Fondiario as Master Servicer of the securitized portfolio and Juliet (owned by Cerved Credit management and Quaestio Capital sgr), Italfondiario, Prelios and Credito Fondiario as Special Servicers of the securitized portfolio, with the responsibility of recovering loans during the entire lifespan of the transaction.

Moody’s report also says that the portfolio sale will involve also a Reoco which each servicer might ask to intervene in an auction if this might be of convenience. In that case mezzanine bondholders will finance the auction deposit and Reoco’s operational costs.

After this deal, Italy’s transactions on non performing exposures tops 54 billion euros this year

Download here the updated table of the deals with links to articles