The Gavio family, through its holding company Aurelia srl, subscribed with Ardian Infrastructure a non-binding Memorandum of Understanding to develop a strategic partnership in the infrastructure sector involving the Astm/Sias group (see here the press release).

The Gavio family, through its holding company Aurelia srl, subscribed with Ardian Infrastructure a non-binding Memorandum of Understanding to develop a strategic partnership in the infrastructure sector involving the Astm/Sias group (see here the press release).

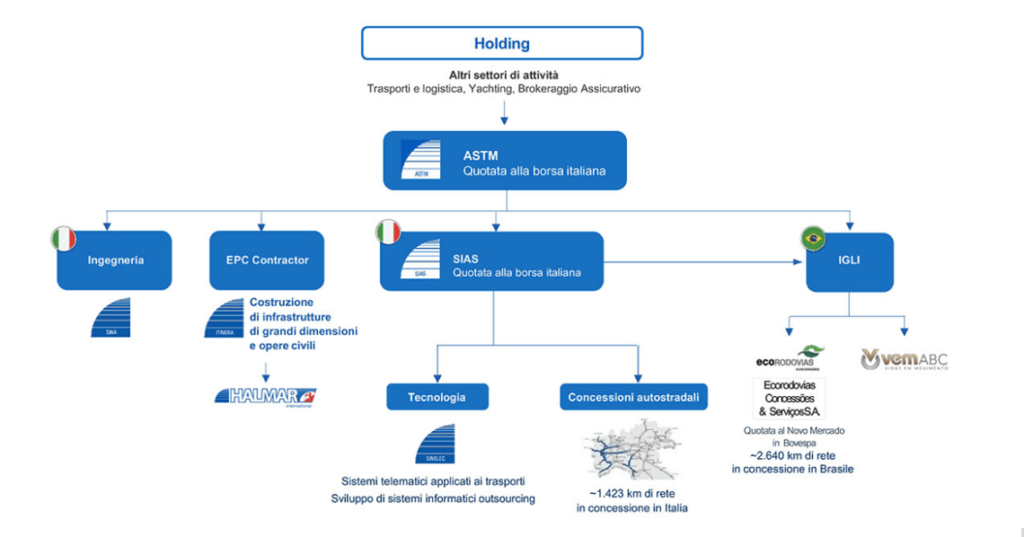

Milan-listed companies Astm spa and Sias spa are today controlled by Aurelia holding through Argo Finanziaria and have activities ranging from the management of motorway concessions to the EPC Contractor sector, from engineering to technology applied to mobility. The group is fourth world operator in the management of toll motorway concessions with over 4,000 km of network under concession in Italy, Brazil and the United Kingdom and through Itinera spa, which boasts an order backlog of over 4 billion euros, is one of the main global players in the construction of major works.

The deal includes the following: 1) the establishment of a newco in which the controlling shareholding stake of Astm spa and Sias spa will be transferred from Aurelia holding; 2) Aurelia will be in control of the newco and then of Astm and Sias; and 3) Ardian will buy a 40% stake of the newco from Aurelia. The Memorandum of Understanding does not include any put option in favour of Aurelia or any call option in favour of Ardian.

Thanks to this deal, the Gavio group aims at a further development of its business worldwide and will be ready to grab opportunities of the market in Europe, Latin America and the United States. The latter are countries characterized by huge greenfield investments in the transport infrastructure sector and by huge competitions programs in the field of road and motorway concessions through the Private Public Partnership (PPP) tool.

The deal is subject to a due diligence by Ardian to be finalized by next July 31st and to 31 luglio 2018 and to obtaining any authorizations requested by the competent authorities.

Pending the authorization of the Ministry of Infrastructure and Transport is also a previous deal between the Gavio group and Ardian announced last June (see here a previous post by BeBeez). That deal concerned the acquisition by the Ardian Infrastructure Fund IV of a 49% stake in Autovia Padana, the company managing the A21 Piacenza-Cremona-Brescia motorway, which is now controlled with a 70% stake by Satap (the company owner of the concessions for A4 Torino-Milano and A21 Torino-Piacenza motoways which is in turn controlled by Sias) and with a 30% stake by Itinera, a an international construction company controlled by Astm.