Intesa Sanpaolo confirmed yesterday it has received a binding offer from Intrum Iustitia for its non performing exposures servicing platform valued 500 million euros and for a 10.8 billion euros GBV bad loans portfolio at a 3.1 billion euros price ( see here the press release).

The offer, if accepted, would generate a net capital gain of around 400 million euros in Intesa Sanpaolo’s consolidated income statement. The offer will be submitted to the Board of Directors of Intesa Sanpaolo convened for today.

Intrum had entered in exclusive talks with Intesa Sanpaolo last February (see here a previous post by BeBeez), winning a competitive offer from Chinese CEFC, joined by Negentropy Capital (see here a previous post by BeBeez).

More in detail Intrum’s offer consists in the merging Intesa Sanpaolo and Intrum’s servicing NPEs platforms in a unique platform servicing a total of 40 billion euros of NPEs. The new platform would be controlled by Intrum with a 51% stake, while Intesa Sanpaolo would own the raining 49%. The new platform would sign a 10-year contract for the servicing of Intesa Sanpaolo bad-loan portfolios, with terms and conditions in line with market standards and would count about 1,000 employees of which 600 people from Gruppo Intesa Sanpaolo.

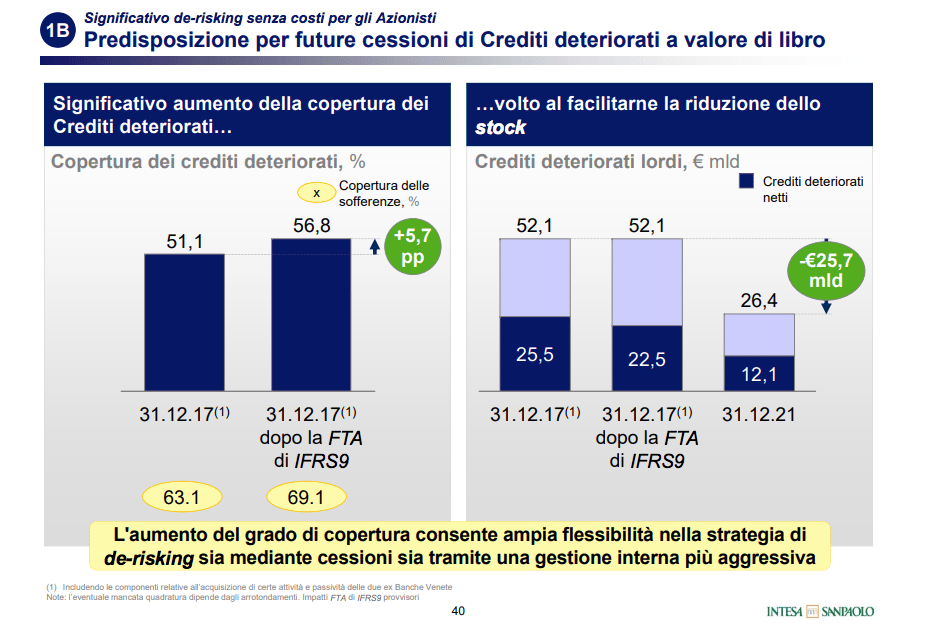

Intrum’s offer also includes the sale and securitization of a 10.8 billion euros bad loans portfolio from Intesa Sanpaolo at a price in line with the carrying value or 3,1 billion euros. In order to obtain the full accounting and regulatory derecognition of the portfolio at the closing date (expected in November 2018), the securitization would be structured with a Tranche Senior equivalent to 60% of the portfolio price, to be underwritten by a pool of leading banks; and with a Junior and a Mezzanine Tranche equivalent to the remaining 40% of the portfolio price, to be underwritten by a vehicle (51%) – to be participated by Intrum and one or more co-investors, but however to act as a single investor for governance purposes – and by Intesa Sanpaolo (49%).