Italian companies found in private debt and bonds issuance a solid alternative to traditional banking credit. On the other side, Italian banks keep offloading their NPLs.

Italian companies found in private debt and bonds issuance a solid alternative to traditional banking credit. On the other side, Italian banks keep offloading their NPLs.

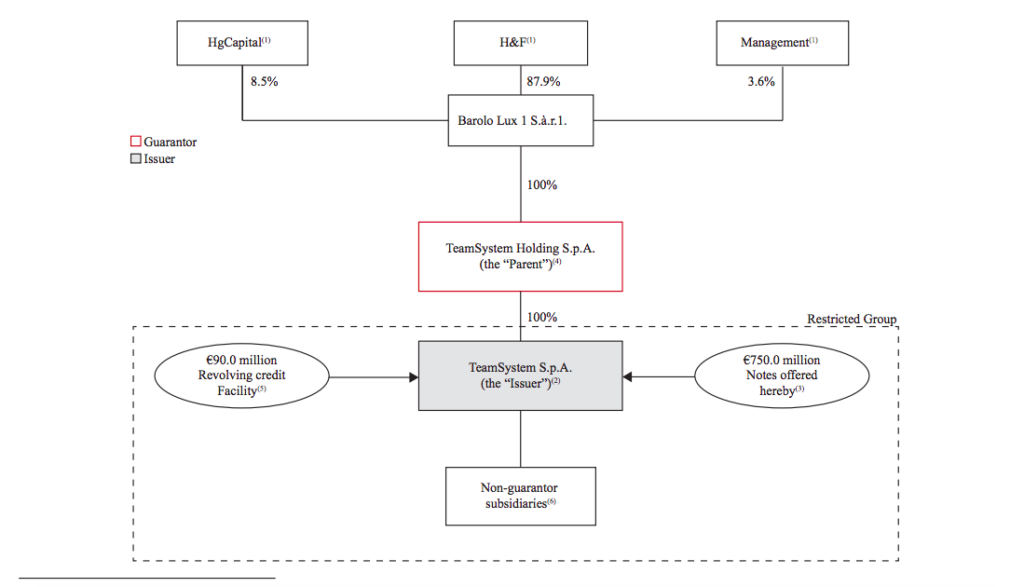

TeamSystem, the Italian publisher of software for business that belongs to financial sponsor Hellman & Friedman, issued two senior secured bonds and listed on Luxembourg stock market (see here a previous post by BeBeez). One of 550 million of euros and the other for 200 million that will respectively come to maturity on 15 April 2023 and on 15 April 2025 and both will pay a coupon of 400 bps over 3-months euribor with a floor rate of 0. Teamsystem will invest the proceeds of such issuance and part of its own cash to reimburse its current liabilities of 150 million and of 570 million due to mature in 2023 and 2022. Hellman&Friedman financed with such debt financed the secondary buyout of the asset in 2016, when financial firm Hg Capital sold a majority stake in the business and kept a minority stake. Last year, Teamsystem posted sales of 316 million, an adjusted ebitda of 113 million euros and net financial debt of 673.3 million.

UBI Banca is considering the sale of a portfolio of Npls worth 3-4 billion of euros, through securitisation with Gacs (see here a previous post by BeBeez). UBI Banca aims to lower its NPE ratio from 15,1% (as at the end of 2015) and its NPL\Assets ratio from current 13% to below 10%. By 2021, UBI also aims to take its NPLs down to 9.8 billion from a current amount of 12.5 billion. In the next years, Banco Bpm aims to sell NPLs worth 13 billion. The bank is currently working on a securitisation of NPLs worth between 5 and 5.5 billion.

Banca Ifis announced the closing of two NPLs deals (see here a previous post by BeBeez). On the ground of a quarterly forward flow transfer agreement, the bank acquired NPLs from an undisclosed Italian consumer credit company (credit cards and personal loans). The first transfer in March was in the region of 35 million of euros. On the sell side, Banca Ifis sold consumer NPLs worth 40 million to an undisclosed investor in distressed debt. In 1Q18 the gross value of the NPLs portfolio of Banca Ifis is worth in the region of 13 billion (13.1 billion last year), for a net value of 799 million.

Creval is selling to financial investor Algebris NPL Partnership II a portfolio of NPLs worth 245 million of euros with a 43% mark-up on the nominal gross value (see here a previous post by BeBeez). Creval said that after such transaction it will achieve 50% of its targets for the sale of Npls as it outlined in its Project Gimli for 2018 (scarica qui il comunicato stampa). The portfolio includes secured credits. Creval could sell this year through a GACS securitisation also a portfolio of gross Npls of 1.6 miliardi named Project Aragon. Between 2019 and 2020 the bank will sell an amount of gross NPLs worth 80 million. Algebris holds a 5% in Creval.