TeamSystem spa refinanced its debt placing two new senior secured bonds for a total of 750 million euros, both paying a floating rate coupon indexed to euribor 3 months plus 400 bps (with a miminum 0% floor).

TeamSystem spa refinanced its debt placing two new senior secured bonds for a total of 750 million euros, both paying a floating rate coupon indexed to euribor 3 months plus 400 bps (with a miminum 0% floor).

As the bond Prospectus explains, the Italian group which is a leader in the development and distribution of software products for businesses and professionals placed 550 million euros of onds maturing on April 15th 2023 and 200 million euros of bonds maturing on April 15th 2025. Goldman Sachs, UniCredit and Ubs were global coordinators and joint bookrunners in the placement while Hsbc, JP Morgan, Mediobanca and Morgan Stanley were other joint bookrunners. The new bonds have been listed on the Luxembourg Bourse.

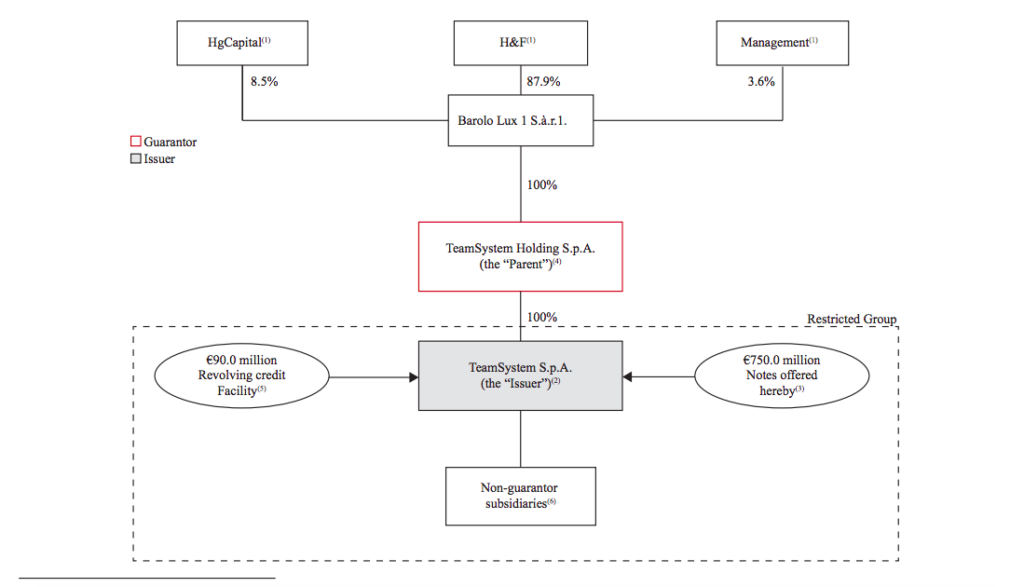

Proceeds from the issue will be used, together with some cash from the company, to reimburse the existing 150 million euros bond maturing in 2023 and the existing 570 million euros bond maturing in 2022, both issued in 2016 to refinance existing debt and finance the secondary buyout by Hellman&Friedman, which bought control of Teamsystem from Hg Capital, which in turn reinvested for a minority stake.

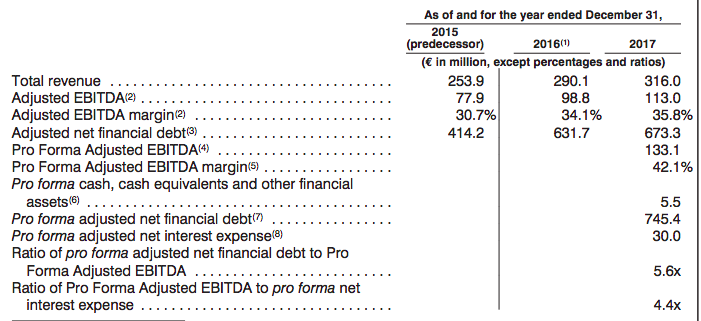

Teamsystem reached 316 million euros in consolidated revenues in 2017, 113 million euros in adjusted ebitda and 673.3 millions euro of net financial debt.

Latham & Watkins law firm supported TeamSystem for the deal issue, Maisto e Associati was the fiscal advisor while Gattai Minoli Agostinelli & Partners supported the global coordinators and the joint bookrunners as for Italian law and fiscal aspects. Gattai Minoli Agostinelli & Partners also supported the previous lending banks as for reimbursement of the existing debt. Finally Weil Gotshal & Manges advised the global coordinators and the joint bookrunners as for the US and British law.