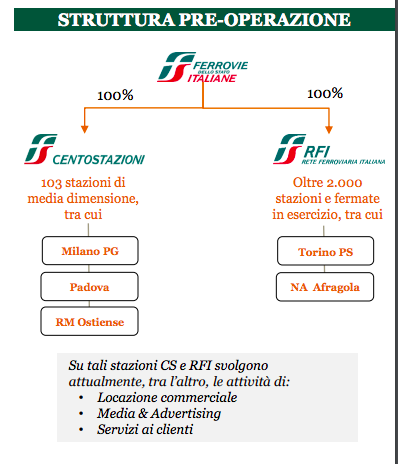

Ferrovie dello Stato started sale auction for the commercial exploitation of the real estate complexes belonging to some medium-sized railway stations with a distinctly retail nature, some of which (Milano Porta Garibaldi, Roma Ostiense, and Padova) are currently managed by Centostazioni spa and others (Torino Porta Susa e Napoli Afragola) by Rete Ferroviaria Italiana spa.

Ferrovie dello Stato started sale auction for the commercial exploitation of the real estate complexes belonging to some medium-sized railway stations with a distinctly retail nature, some of which (Milano Porta Garibaldi, Roma Ostiense, and Padova) are currently managed by Centostazioni spa and others (Torino Porta Susa e Napoli Afragola) by Rete Ferroviaria Italiana spa.

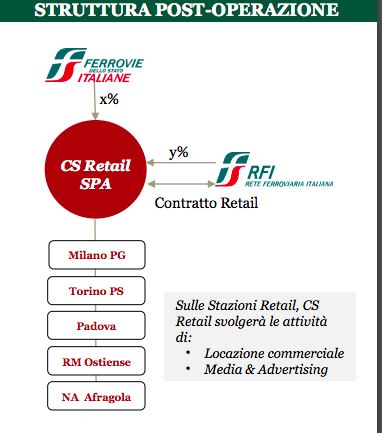

The activities and contractual arrangements related to the exclusive economic exploitation of the commercial and advertising spaces in the those stations will be transferred to a newco named Centostazioni Retail (Cs Retail) spa, which is the object of the sale procedure. Financial advisor for the sale is PwC Advisory.

All that is written a call for expression of interest published on FS internet site, telling that expressions of interest are due by 12 am next April 13th.

The parties that may request to be admitted to participate in the procedure may be Italian or foreign entities, with a legal personality according to the legislation of their State, including investment funds, in single or associated form, in this phase or in subsequent phases of the procedure, on the basis of pooling agreements or similar forms of cooperation, also through special corporate organizations or in the form of consortia or temporary corporate groupings. Natural persons and/or associative structures and/or other forms of association other than those indicated above will not be admitted to the procedure.

Those parties must meet the following requirements: to have achieved in the last three financial years (2015, 2016, 2017) an average annual gross turnover at least equal to 70 million euros (or equivalent value in foreign currency), of which at least 50 millions (or equivalent value in foreign currency) in the specific field of management and/or development of commercial and advertising; to have closed the last financial year (2017) with a net equity of not less than 75 millions (or equivalent value in foreign currency).

A teaser prepared by PwC says that pro-forma data for FY 2017 are: 19k leased retail areas, about 60 shops, 7 million euros of revenues and about 3 millions of ebitda. milioni e un ebitda di 3 milioni. At full potential (or in 2023 for Milano PG, Torino PS, Padova and Roma Ostiense stations and in 2026 for Napoli Afragola), CS Retail is expected to have 26k leased retail areas, 170 shops, 20 million euros in revenues and 10 millions in ebitda.

The company reorganization aimed at selling those assets will be carried through the following steps:

a) the CS demerger, which will attribute to CS Retail all activities and contractual arrangements related to the economic exploitation of the commercial and advertising spaces in CS Stations and the granting of the right of the economic exploitation in exclusivity of the commercial and advertising spaces in CS Stations through a specific agreement to be concluded between CS and CS Retail (the “Retail CS Contract”);

b) the merge of the demerged CS into RFI, which will consequently result in RFI being a direct counterpart of CS Retail in the Retail CS Contract;

c) the RFI contribution to CS Retail of all activities and contractual rights related to the economic exploitation of the commercial and advertising spaces in RFI Stations, with the granting of the right of the economic exploitation in exclusivity of the commercial and advertising spaces also in RFI Stations through a specific agreement between RFI and CS Retail, which will constitute an extension of the Retail CS Contract (“Retail Contract”). Following the RFI contribution, the entire CS Retail share capital will be owned by FS and RFI, with each entity having its own stake.

Among potential investors is for sure Grandi Stazioni Retail (Gs Retail), the group which owns the long term license for the commercial exploitation of the real estate complexes belonging to 14 big-sized railway stations in Italy (and other two stations in the Czech Republic) which was bought in June 2016 by a consortium made by Antin Infrastructure, Icamap and BG Asset Management (Borletti Group) for a 953 million euros valutation. The sellers were Ferrovie dello Stato and Eurostazioni (Edizione srl, Vianini lavori, Pirelli e Sncf) (see here a previous post by BeBeez).

CS Retail might be of intereste to other investors too. As for Reuters some potential bidders are said to be Altarea, Lone Star and Deutsche Bank’s infrastructure fund. All the latter arrived at the last phase of GS Retail auction in 2016 but lost the race as they offered rather less than the winners: erano tutti arrivati alle battute finali della gara per GS Retail, ma avevano offerto molto meno del consorzio vincitore: la cordata Altarea-APG-Predica offered 806.5 millions, Lone Star 800 millions and Deutsche Bank 744.5 millions.