Lindorff-Intrum Justitia entered in exclusive talks ending on March 31st with Intesa Sanpaolo aiming to buy the bank’s servicing and non performing loans management platform, Bloomberg wrote.

Lindorff-Intrum Justitia entered in exclusive talks ending on March 31st with Intesa Sanpaolo aiming to buy the bank’s servicing and non performing loans management platform, Bloomberg wrote.

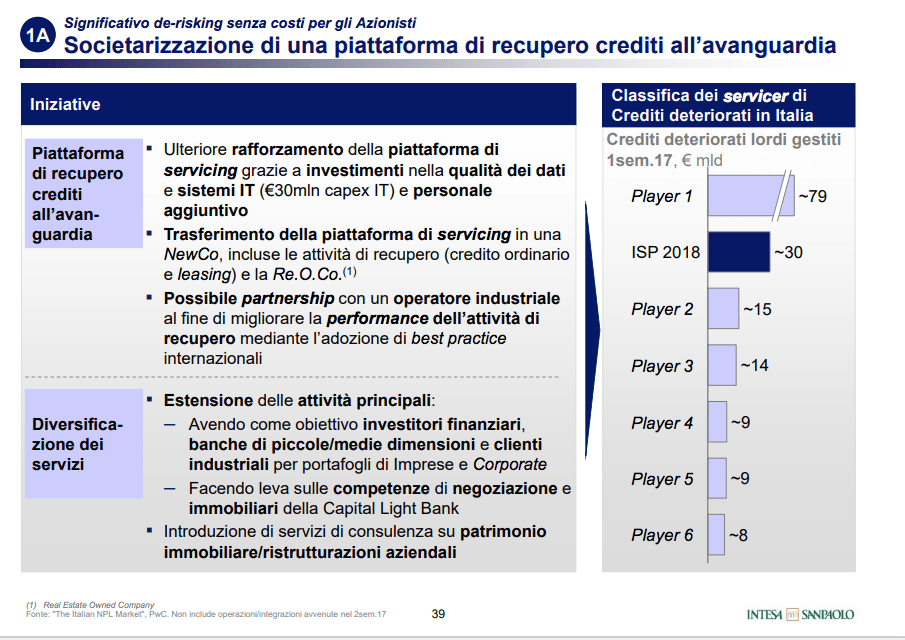

Actually Intesa Sanpaolo explained in its strategic plan a few weeks ago that the platform will be sold to a newco in partnership with an industrial partner (see here a previous post by BeBeez). Lindorff-Intrum Iustitia so beated for the moment a competitor bid by Chinese CEFC, who was joined by London-based investment firm Negentropy Capital (see here a previous post by BeBeez).

Lindorff-Intrum Justitia is said it might buy a 51% stake in the newco, valued about 500 million euros. Overall the platform would work on a 12 billion euros GBV non performing loans portfolio with a 3.5 billion euros net value to be financed for 2 billions in dbet and for 1.5 billions in equity. This is why Lindorff-Intrum is said to be looking for an equity partner for the deal.

Financial advisors to Lindorff-Intrum for the deal are Mediobanca and Goldman Sachs while Rcc, Orrick and Chiomenti law firms are advising about legal issues, MF Milano Finanza writes today.

Lindorff-Intrum, led in Italy by Antonella Pagano, is now studying a debt structure for the deal which might include both a senior financing and mezzanince finance, for a total leverage of aboout 60%.

For a summary of all Italian NPLs deals coming this year and deals closed last year, click here