Italy’s Esaote, one of the world’s leading manufacturer of medical diagnostic systems, becomes Chinese (see here the press release). The acquiror is a consortium of leading Chinese investors composed of leading medical technology and healthcare companies, as well as financial investors with significant experience in the healthcare sector.

Rumors about a potential sale of the company had started more than one year and half ago. Back then Esaote was said to be valued about 400 million euros (see here a previous post by BeBeez).

The acquiring consortium includes:

• Shanghai Yunfeng Xinchuang Investment Management (YF Capital), the Chinese private equity co-founded by Jack MA (founder and chairman of Alibabna group) and David YU (former chairman of Focus Media);

• Beijing Wandong Medical Technology, China’s largest listed medical imaging equipment manufacturers with the longest history, and one of the largest providers of diagnostic services with over 60 years’ experience and over 100 patents in medical equipment sector, and produced the first X-Ray and cardiovascular systems in China;;

• Shanghai FTZ Fund Management,China’s first Free Trade Zone fund established in 2014 as part of the State Council’s initiative to further reform and open up the Chinese economy. Shanghai FTZ Fund has made extensive investments in the healthcare sector;

• Shanghai Tianyi Industries Holding, a leading investment group focused on the healthcare sector with investments in more than 20 companies, including Meinian Onehealth Healthcare Holdings (the largest listed healthcare services company in China), Wandong, and Ciming Health Checkup Management Group;

• Jangsu Yuyue Science & Technology Development, the holding company of Jangsu Yuyue Medical Equipment & Supply (the largest homecare medical equipment manufacturer in China) and the largest shareholder of Wandong;

• Shanghai Kangda Medical Equipment Group Corporation, a leading OEM manufacturer and distributor of medical imaging equipment.

Esaote had been controlled for 8 years and half by Ares Life Sciences, a private equity fund focused on scientific and medical sectors owned by Ernesto Bertarelli. The rest was owned by funds managed by Neuberger Berman (19.2%), MP Venture (13.2%) and Equinox (13.2%), while the company owned a 3.8% stake in its own shares.

Chaired by Paolo Monferino and led by ceo Karl-Heinz Lumpi, Esaote posted 270 million euros in revenues in 2016 (down from 280.1 millions in 2015), an ebitda higher than the 37.3 millions posted in 2015 and a positive net result from 3.7 millions in net losses in 2015.

The deal will allow Esaote to further grow internationally. The Consortium will leverage the distribution networks of Wandong, Yuwell, Meinian and Kangda to increase Esaote`s penetration in the Chinese medical imaging equipment market. In parallel, Esaote will distribute the consortium’s relevant medical products in international markets where the Company operates. Esaote’s ceo Karl-Heinz Lumpi will continue to lead the company which will continue to operate as an independent global medical equipment company, headquartered in Genoa, Italy, with R&D and manufacturing facilities in Italy and the Netherlands.

Moelis & Company acted as the exclusive financial advisor to the consortium. Freshfields Bruckhaus Deringer acted as the legal advisor to the consortium. The shareholders of Esaote have been assisted by Rothschild as the financial advisor, whilst Ares Life Sciences, as main shareholder of Esaote, has been assisted by Legance Avvocati Associati as legal advisor. Esaote has been assisted by Bonelli Erede as legal advisor.

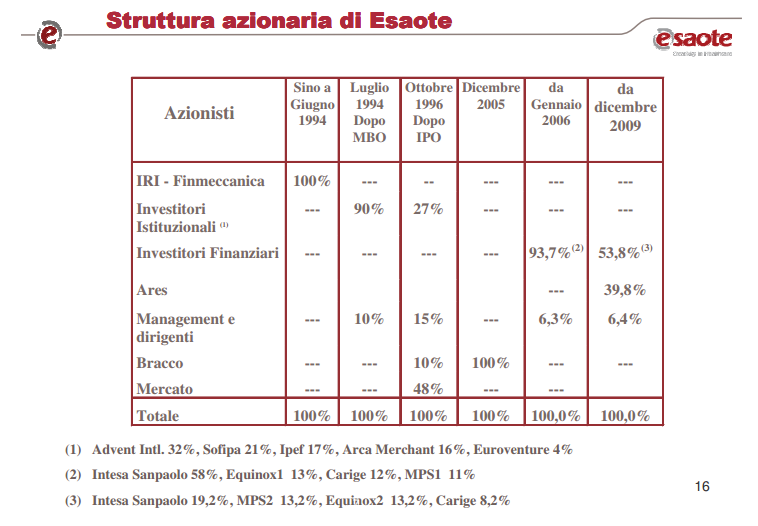

Ares Life Sciences fund acquired a 39.2% stake in November 2009 in a deal that valued the company 280 million euros and that consisted in the reorganization of the company’s shareholders stakes with the previous shareholders who lowered their stakes as follows: Intesa Sanpaolo bank to 19.2%, Equinox Two fund and Mps Venture 2 fund to 13.2% each and Banca Carige to 8.2%, while the management retained the remaining stake (see here the press release). In July 2014 Carige banks sold a 7.4% stake to Ares Life per a 17 million euros price, retaining a 0.77 (see here the press release) while one of the managers sold Ares its 0.8% stake so the fund raised its stake in Esaote to 48% (see Reuters).

Founded in Genoa in 1982 as a startup inside Ansaldo group, in 1994 Esaote was target of a management buyout which was financed by Advent International (32%), Sofipa (21%), Ipef(17%), Arca Merchant (16%), Euroventure (4%): 22 managers became shareholders for a 10% initial stake while a few months later 53% of Esaote’s employees subscribed a convertible bond. In 1996 Esaote was listed at the Milan Stock Exchange and pharma company Bracco bought a 10% stake. Bracco bought then the entire capital of the company in a tender offer in 2003 for a 5.16 euro per share price.

In 2006 Esaote was a target for a second management which was financed by Intesa Sanpaolo, Mps Ventures, Equinox Two and Banca Carige: a 100 managers took part in the deal. In 2009 Ares Life Science led a new deal (see here Easote’s history told by former chairman Carlo Castellano).