Qatar Investment Authority is studying a way to be allowed to invest in Italy’s leading supermarket chain Esselunga, MF Milano Finanza, writes today adding that QIA’s head of consumer and retail investments, Ugo Arzani, is still trying to take home a deal even if a few months ago the founding family Caprotti said no to a 7.3 billion euros offer by Chinese Yida Investment Group.

Qatar Investment Authority is studying a way to be allowed to invest in Italy’s leading supermarket chain Esselunga, MF Milano Finanza, writes today adding that QIA’s head of consumer and retail investments, Ugo Arzani, is still trying to take home a deal even if a few months ago the founding family Caprotti said no to a 7.3 billion euros offer by Chinese Yida Investment Group.

In te meantime Esselunga has sold two bonds maturing in 6 and 10 years for a total value of one billion euros in order to finance a first step in the shareholders’ reorganization of the group with a second step being a listing at the Milan Stock Exchange in the medium term. The issue has been more than 9x oversubscribed (orders were 9.2 billion euros) with a 70% orders coming from forwign investors.

The two bonds have a 500 million euros size each and are listed on the Luxembourg Stock Exchange. One bond matures on October 25th 2023 and pays a 0.875% coupon, while the other matures on October 25th 2027 and pays a 1.875% coupon.

Joint lead manager have been Banca Imi, Citigroup, Mediobanca and UniCredit, while co-managers have been Banca Akros and UBI Banca.

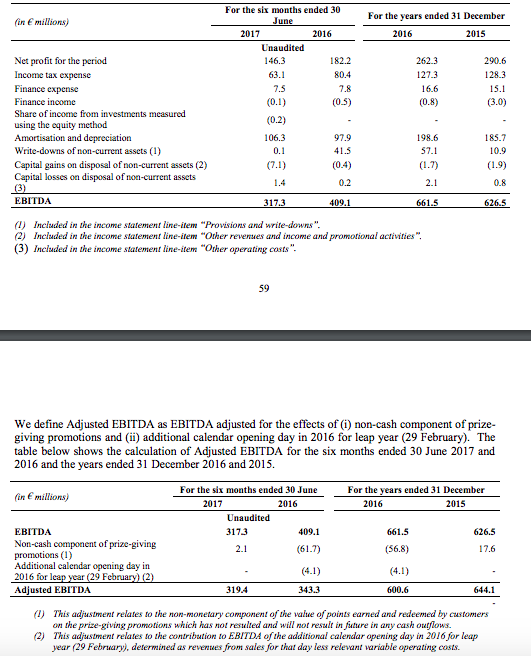

As stated in the bond issue prospectus, Esselunga reached 3.8 billion euros in revenues in H1 2017 with 319.4 million euros in adjusted ebitda.