Kedrion, a leading Italian operator and in 5th place worldwide in the sector of plasma derivatives, is said will have a new minority shareholder soon, Il Sole 24 Ore wrote, adding that Lazard is said to be the mandated advisor and the industrial Chinese groups are said to be looking at the deal.

Kedrion, a leading Italian operator and in 5th place worldwide in the sector of plasma derivatives, is said will have a new minority shareholder soon, Il Sole 24 Ore wrote, adding that Lazard is said to be the mandated advisor and the industrial Chinese groups are said to be looking at the deal.

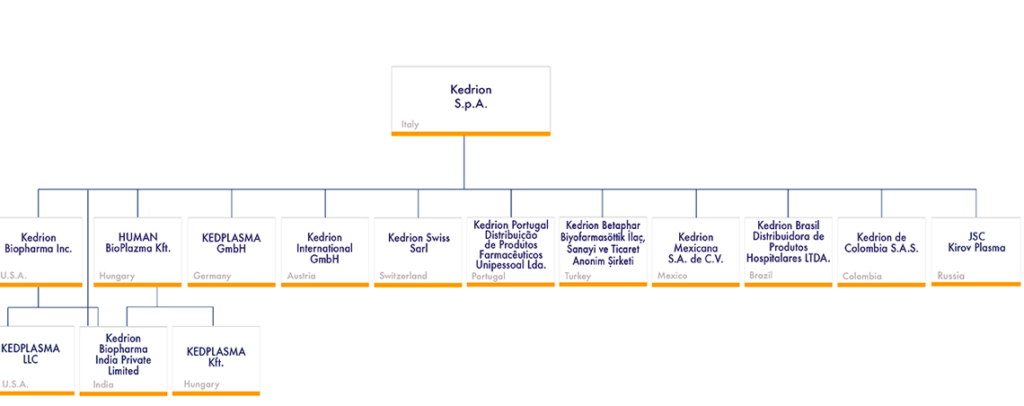

Kedrion is controlled by the Marcucci family and Cdp Equity (former Fondo Strategico Italiano) owns a 25.1% stake.

Last July the group issued a 350 million euros bond maturing in 2022 and paying a 3% (see here a previous post by BeBeez). Proceeds from the bond were intended to finance the acquisition of Kedrion’s bond matuing in 2019 and paying a 4,25% coupon after the group had launched a tender offer on the bond last June.

Led my chairman and ceo Paolo Marcucci, Kedrion reached 659.3 million euros in consolidated revenues in FY 2016 (from 570.3 millions in 2015), almost 300 million euros of which from the US, where the group in 2012 had bought Rhogam, a subsidiary of Johnson&Johnson’s, thanks to a capital increase by Fondo Strategico, which forst invested for a 18.7% stake, with the committement of investing till 150 million euros. Till now Cdp Equitys’ total investment in Kedrion has been 100 million euros for a 25.1% stake.

Coming back to FY 2016’s statements, Kedrion posted a 106.3 million euros ebitda (from 118.9 millions) with a net financial debt of 339.1 millions (from 332.3 millions) and total investments for 71.6 millions, 33 millions of which in R&D.

About one year ago ruors about a possibile listing of the group came back after Kedrion had studied but then abandoned an ipo project in 2013 (see here a previous post by BeBeez). In the Summer of 2013 Investitori Associati private equity firm sold to the Marcucci family its 32.25% stake for 196 million euros (after having invested in Kedrion in 2006 67 million euros), on the basis of an enterprise value of 602 million euros.

Before that, in July 2008, Kedrion had arrived at announcing a 9-12 euro per share pricing range for a listing on the Italian Stock Exchange on the basis of an enterprise value of 557-703.4 million euros. However ipo was then canceled as institutional investors judged the price too high.