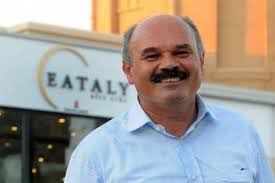

Eataly, the well known Italian luxury retail food chain founded by Mr. Oscar Farinetti, will be listing on the Italian Stock Exchange in the first semester of 2018 as it was stated in its strategic plan (see ahere a previous post by BeBeez).

Tamburi Investment Partners (TIP), an independent investment bank listed on the Italian Stock Exchange which has led a club deal who bought a 20% stake in Eatinvest, Eataly’s parent company, in March 2014 (see here a previous post by BeBeez), will call Eataly’s Board of Directors’ meeting next October in order to give the official go ahead to the listing project, MF Milano Finanza wrote, adding that the company will list with a 33% floating capital. A news that was confirmed last Friday in an tv interview to ClassCnbc by Mr. Gianni Tamburi, TIP’s founder.

Unicredit will be appointed global coordinator of the ipo which is going to be a so-called opv or sale public offer, meaning that the public will be offered just shares which are now owned by actual shareholders and no capital increase is to come. The offer might be destinated mainly to retail investors.

Eataly, which is managed by the executive chairman Andrea Guerra, closed FY 2016 with revenues just under 400 million euros, in line with FY 2015 and an ebitda which was under the 2015’s one (which was 30 millions, well under 2014’s 39 millions). The ebitda drop was due to extraordinary costs and some delays in new shops openings (see here a previous post by BeBeez). Moreover the Italian business, which still has a major weight on the whole business, swa a 15.5% drop in revenues in 2016 to 178.8 million euros and an 11 million euros net loss (from 0.7 millions net profit in 2015, which was the year of Expo in Milan). As for FY 2017, estimates are that revenues are reaching 500 million euros and ebitda is staying in a 25-30 million euros range. That said growth is seen especially abroad.

Mr. Farinetti is keeping on saying that its creature is 3 billion euros worth. That value however is seen quite high by the market as this would mean a 100x ebitda evaluation of 6x sales. However bankers and advisors are said to be willing to try a 2 billion euros evaluation which is certainly not low anyway.

On this topic Mr. Tamburi said to ClassCnbc that price “will be very high”, adding that “press rumors talked of one billion euros once and 3 billions another time, so that’s why the market is confused”. However, Mr. Tamburi added, “there is a huge interest on the dossier from international investors” and “Eataly will be the new Ferrari”.