Manutencoop Società Cooperativa, the major shareholder of Italian facility management company Manutencoop Facility Management (MFM), is looking for a new way to refinance its debt and liquidate MFM minority shareholders owning 33.2% stake in the company’s capital.

Manutencoop Società Cooperativa, the major shareholder of Italian facility management company Manutencoop Facility Management (MFM), is looking for a new way to refinance its debt and liquidate MFM minority shareholders owning 33.2% stake in the company’s capital.

In order to reach this target, US hedge fund Elliott is said to be on talks with Manutencoop Società Cooperativa in order to issue a 180 million euros financing, Il Sole 24 Ore wrote.

Actually last June Manutencoop Società Cooperativa announced that it had decided to buyback that 33.2% stake from the minority shareholders funding the deal by issuing a new 420 million euros bond (through its subsidiary CFM spa) which, together with 167 million euros of company’s cash, would have also helped to refinance company’s debt (see here a press release by Moody’s). However the bond didn’t win strong investors’ demand so the issue size was shrinked to 360 million euros and the yield was raised to 9% from 8.5% (see here a previous post by BeBeez).

MFM indirectly confirmed that such talks are on their way saying in a press release that it continues to evaluate several alternative solutions with the objective of facilitating the exit of the current minority shareholders in its subsidiary, Manutencoop Facility Management and to acquire 100% of MFM. No final agreement has been entered into in respect such alternatives.

The reduction of the bond size was then enough any more in order to pay 205 million euros to minority shareholder, to reimburse 48 million euros of revolving lines and to buyback the remaining 300 million euros of a 425 million euros bond issued in 2013 (after two previous bond buybacks in 2014 and 2015).

That’s why MFM’s H1 2017 Financial Interim Report explains that MFM would have issue a new equity or debt instrument for 50 million euros in the next few months.

In Summer 2016 (see here a previous post by BeBeez) MFM’s financial shareholders (Private Equity Partners sgr, 21 Investimenti sgr, MPVenture sgr, Sviluppo Imprese Centro Italia sgr, NEIP II, IDeA Capital Funds sgr and Cooperare spa, Unipol Banca e Mediobanca) signed an agreement to raise their stake to 33.2% of Manutencoop’s capital, while Manutencoop Società Cooperativa retained a 66,8%. The stake was transferred last October 7th and the agreement between the counterparts included that starting in January 2017 exit procedures would be stared with the aim of a sale or a listing on the Italian Stock Exchange.

Last January MFM’s shareholders have been receiving some unsolicited expressions of interest for control of the leading Italian facility management company (see here a previous post by BeBeez). Among potential investors Pai Partners and BC Partners were said to be looking at the deal. In June however a different way was chosen with the bond issue.

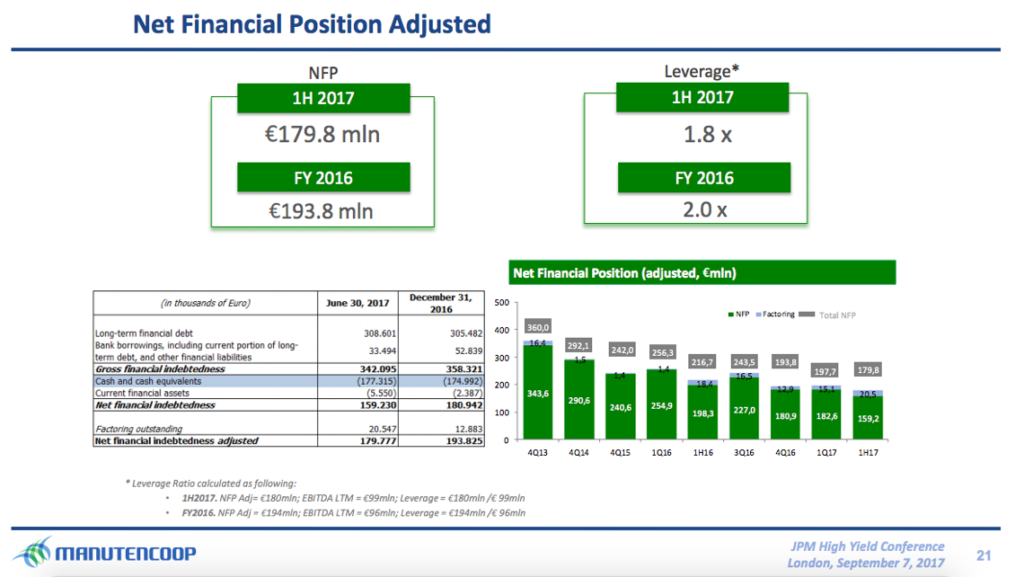

MFM reached 455.3 million euros in revenues in H1 2017 (from 471.5 millions in H1 2016), with 50 million euros in adjusted ebitda (from 52.4 millions) and a net profit of 15.7 millions (from 13 millions), with 180 million euros in adjusted net financial debt (from 197.7 million euros at the end of last March).

MFM chad closed 2016 FY with 921.9 million euros in consolidated revenues (from 955.7 millions in 2015), with 95.9 millions of ebitda (from 93.1 millions) and a net financial debt of 194 millions (from 242 million euros in December 2015).