Gamenet Group spa, one the major gaming operators in Italy controlled by private equity fund Trilantic Capital Partners Europe, which merged in 2016 with Intralot Italia, filed with Borsa Italiana a request for eligibility to list its shares on the MTA market and also filed Consob the request for approval of the registration document.

More in detail, the ipo will consist in a sale of a part of the stakes in Gamenet’s capital owned by shareholders Tcp Lux Eurinvest sarl (79.068%) and Intralot Italian Investments bv (20%).

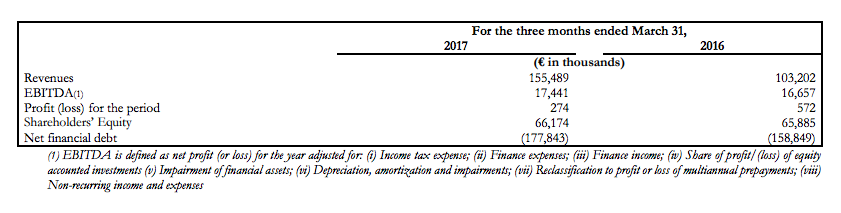

Led by ceo Guglielmo Angelozzi, Gamenet reached 155 million euros in revenues in Q1 2017 with 17.4 millions in ebitda and a 177.8 million euros net financial debt, after having closed FY 2016 with 537.5 million euros of net revenues, a 70.2 million euros ebitda and a 158.3 millions net financial debt.

In July 2016 Gamenet issued a new 200 million euros bond maturing on August 15th 2021 and paying a 6% fixed coupon which has been listed on the Luxembourg Stock Exchange. Proceeds from the new bond were used to refinance a previous 200 million euros bond which had been issued in July 2013 and maturing in 2018 with a 7.25% fixed coupon. That bond had been listed on the Extra Mot Pro market manged by Borsa Italiana and was bought back by Gamenet with a tender offer.

In July 2016 Gamenet issued a new 200 million euros bond maturing on August 15th 2021 and paying a 6% fixed coupon which has been listed on the Luxembourg Stock Exchange. Proceeds from the new bond were used to refinance a previous 200 million euros bond which had been issued in July 2013 and maturing in 2018 with a 7.25% fixed coupon. That bond had been listed on the Extra Mot Pro market manged by Borsa Italiana and was bought back by Gamenet with a tender offer.