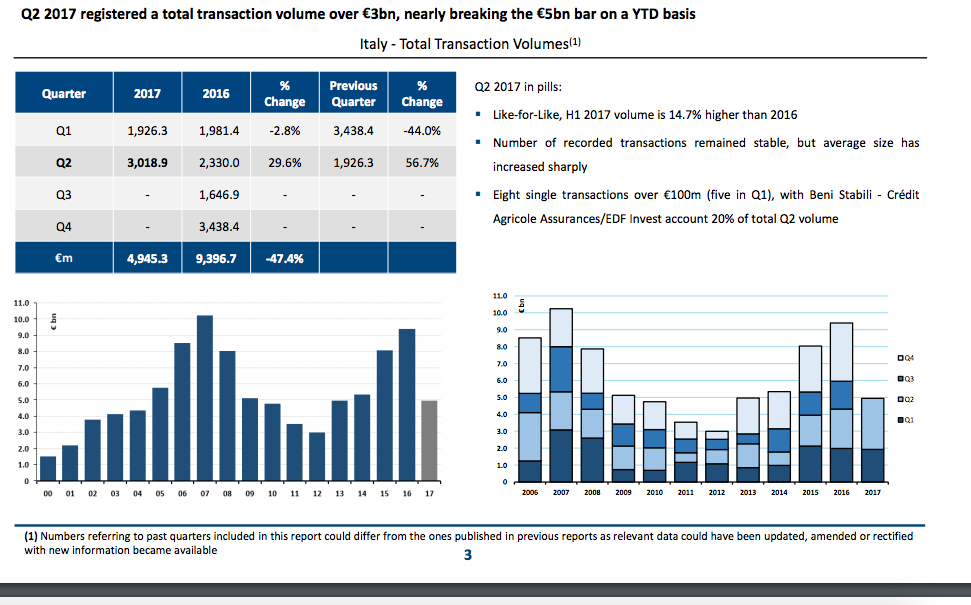

Commercial real estate transactions topped 3 billion euros in value in Italy in Q2 2017 with 42 deals, up from 1.9 billions and 42 deals in Q1 2017, but down from almost 3.5 billions and 57 deals in Q4 2016, Resolute Asset Management says in its last report on the sector in Italy, stressing that transactions in commercial real estate were just slightly lower than 5 billion euros in the semester.

Commercial real estate transactions topped 3 billion euros in value in Italy in Q2 2017 with 42 deals, up from 1.9 billions and 42 deals in Q1 2017, but down from almost 3.5 billions and 57 deals in Q4 2016, Resolute Asset Management says in its last report on the sector in Italy, stressing that transactions in commercial real estate were just slightly lower than 5 billion euros in the semester.

Transactions were concentrated in Northern Italy as usual (37.9% of total value) and above all in Lombardy (22.2%), followed by the Lazio Region (18.8%) and Emilia Romagna (9.6%). In Q1 2017 transactions were even more concentrated with Lombardy accounting 38.7% of the total value, followed by Lazio with just 11.9%.

The average deal value was up to 71.9 million euros from 45.2 millions in Q1 and from 60.3 millions in Q4 2016 (with a 55.6 million euros average deal value in the whole 2016). Sellers in Q2 were Italian owners above all for a total of about 2.25 billion euros, while buyers were international players above all for a total value of about 2.38 billion euros.

Resolute am’s report details all the deals announced in Q1 and Q2 2017. The biggest deal was the dale of a 40% stake in the major Sicaf managed by Beni Stabili Siiq to Crédit Agricole Assurances and EDF Invest valued 617,2 million euros, folowed by the sale of the socalled Milano 90 portfolio valued 415 milioni by gruppo Scarpellini to a fund managed by Idea Fimit sgr and entirely subscribed by Tristan Capital Partners, York Capital and Feidos.