Italian secured bad loans portfolios prices were down to 33% of gross book value at the end of Q2 2016 from 43% at the end of 2016 as a consequence of the increasing offering of this typology of portfolios on the market, Banca Ifis said in its last Npl report called Market Watch Npl.

Italian secured bad loans portfolios prices were down to 33% of gross book value at the end of Q2 2016 from 43% at the end of 2016 as a consequence of the increasing offering of this typology of portfolios on the market, Banca Ifis said in its last Npl report called Market Watch Npl.

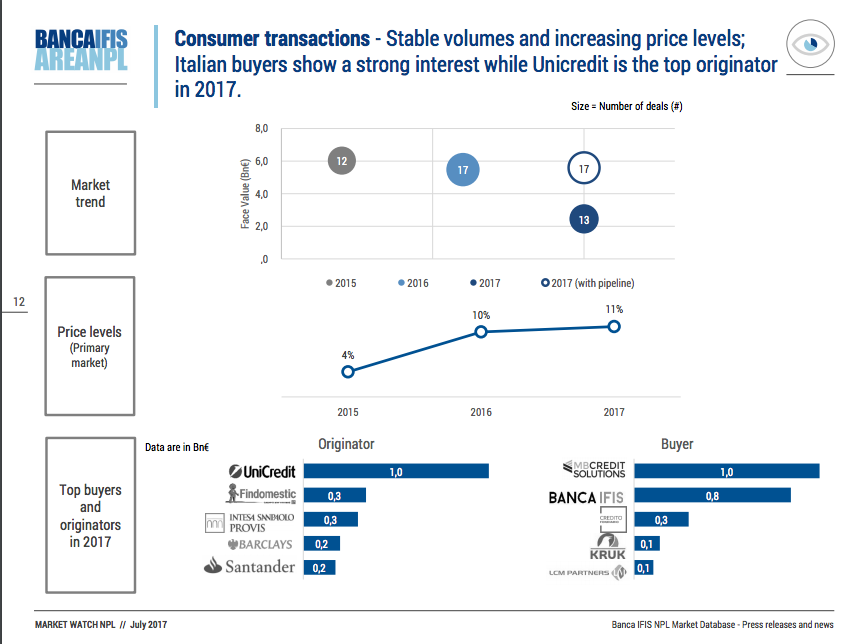

On the opposite, the price levels of consumer portfolios (around 11%) are experiencing a different trend: the higher demand and the improved quality of the assets are pushing the prices up. For example, in the last few days Unicredit’s securitization of 17.7 billion euros GBV Npls (project FINO, see here the press release and a previous post by BeBeez) ) were priced at 13%, which is a price higher than Q2 level related on mixed category; and Creval securitized 1,4 billion euros pricing at 37,5% of nominal values.