Tikehau Capital put forward a binding offer together with Italy’s investment holding Italmobiliare spa to buy all stakes in Fondo Italiano d’Investimento, now managed by Fondo Italiano d’Investimento sgr.

Tikehau Capital put forward a binding offer together with Italy’s investment holding Italmobiliare spa to buy all stakes in Fondo Italiano d’Investimento, now managed by Fondo Italiano d’Investimento sgr.

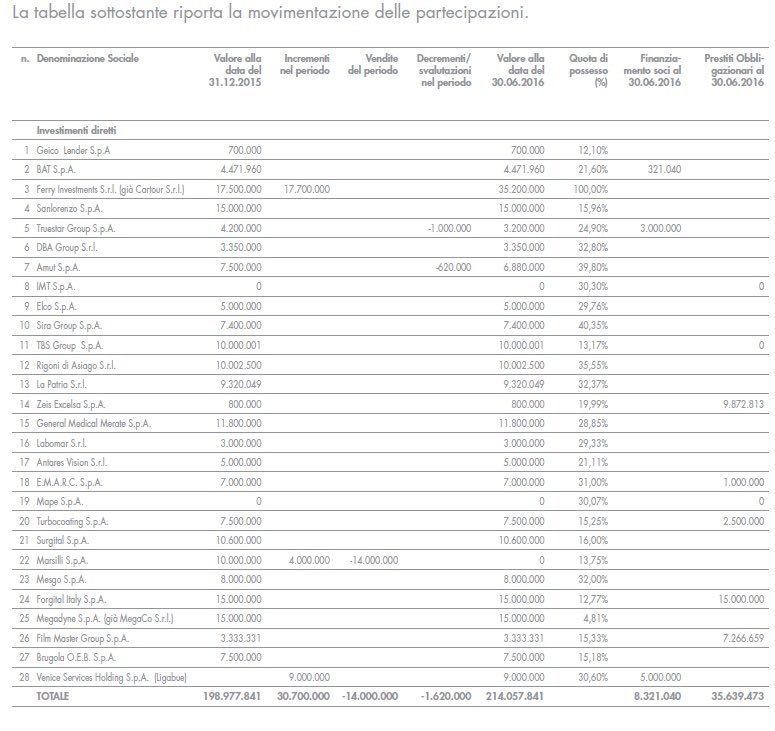

The news was given yesterday in a press release, adding that the joint venture aims at giving continuity to economic and strategic support to the 23 Italian SMEs in the fund portfolio (see here the press release).

Tikehau has been said for months to be studying the dossier. But the French asset manager is not the only one to be willing to buy control of the Italian government sponsored fund.

US asset manager Neuberger Berman is said to be quite interested in the deal (see here a previous post by BeBeez). Neuberger Berman used to be Lehman Brothers asset management branch and a couple of years ago gave birth to NB Reinassance in Italy, an investment veichle born from Intesa Sanpaolo’s private equity activities (see here a previous post by BeBeez).

The project to create Fondo Italiano d’Investimento sgr management company and to promote the fund was developed by a steering committee created in December 2009, including representatives from the Italian Ministry of Treasury and Finance, some sponsor banks (Unicredit, Intesa Sanpaolo, Banca Mps and Cassa Depositi e Prestiti), Confindustria (the Italian Industrial Association) and Associazione Bancaria Italiana (the Italian Banking Association).

In the second half of 2010 the first Fondo Italiano di Investimento was launched, a closed-end investment fund for qualified investors, investing in the risk capital (private equity) of SMEs that operate in various industrial, trade and services sectors to accompany them, coherently and professionally along their growth plans. The fund, whose total amount is 1.2 billion euro, operates through both direct investments and indirect investments as “fund of funds”.

Cdp, Mps, Intesa-Sanpaolo and UniCredit underwrote an initial commitment of one billion euros, later followed by the 200 million euros commitment underwritten by some medium-size banks (Icbpi, Credito Valtellinese, Banca Popolare di Milano, Banca Popolare dell’Emilia Romagna, Ubi Banca and Banca del Cividale).