DoBank, a leading Italian banking group specialized in managing non performing loans (former UniCredit Credit Management Bank or Uccmb, see here a previous post by BeBeez) controlled by Fortress Investments Group), announced that on June 13, 2017 it has filed an application with Borsa Italiana for the admission to listing of its ordinary shares and has filed with Consob its Registration Document, a Securities Note and a Summary Note (see here the press release).

The shares will be offered to institutional investors in Italy and abroad and it is expected that the transaction will be completed by the end of July (see here a previous post by BeBeez).

The shares to be offered will be sold by Avio sarl, a company incorporated under the laws of Luxembourg, which currently holds 97.81% of the company’s share capital (the remaining 2.19% is represented by treasury shares held by the company itself). Siena Holdco sarl, a company controlled by funds managed by Fortress Investment Group, holds 50% of Avio’s share capital and Verona Holdco sarl, a company controlled by Eurocastle Investment Limited, a company controleld by Fortress and whose shares are listed on Euronext Amsterdam, holds the remaining 50% of Avio’s share capital.

The company and Avio will be subject to customary lock-up commitments, for a period of 180 days from the date of the listing of the shares.

Citigroup, JPMorgan and UniCredit are acting as joint global coordinators and joint Bbookrunners. UniCredit is also acting as sponsor and Citigroup as stabilization agent. Rothschild is acting as financial advisor to Avio and the doBank.

Ipo details have not been disclosed yet but doBank is said to have an equity value of more than 700 million euros and is expected to float about 40% of its capital in a sole sale public offering (ie without any capital increase).

Fortress’ managment in a meeting with analysts in Milan last March said that doBank’s comparables quote at an enterprise value of 10-12x ebitda and in the high price range doBank would be valued 13.8x to 16.2 x 2017-2018 ebitda (see MF Milano Finanza), meaning an enterprise value of 850 million to one billion euros.

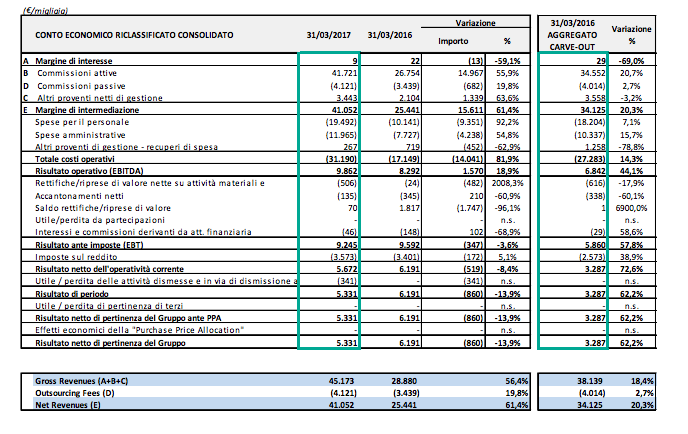

doBank’s Q1 results show that the bank reached 45.17 million euros in revenues at the end of March 2017 with a 9.9 million euros ebitda from 8.3 millions in Q1 2016. In FY 2016 doBank had reached a 58 million euros consolidated ebitda with 206.2 million euros in revenues, comprised of 93% from revenues from servicing activities (92% as of March 31, 2017), 4% from ancillary products (3% as of March 31, 2017) and 3% from other secondary banking activities (5% as of March 31, 2017).

As of March 31, 2017, the doBank Group had approximately 1,230 employees, including 800 asset managers, operating through a network of 21 branches located throughout Italy and utilized a network of 1,800 highly-experienced professionals and lawyers. The size of the Group and its scalable platform enable the Group to manage even higher volumes of loans

DoBank bought Italfondiario, the second independent credit servicer in Italy, last July. Sellers had been funds managed by Fortress itself (who owned an 88.75% stake in Italfondiario after having invested in August 2000 in the company for the first time) and Intesa Sanpaolo bank, owning the remaining 11.25% stake. The value of the deal had not been disclosed but doBank reported 90 million euros in revenues in 2015 while Italfondiario reported 56.4 millions, PwC wrote in a report last June (see here MF Milano Finanza).

The deal gave birth to the biggest independent credit servicing group in Italy as far as doBank and Italfondiario were, respectively, number one and number two in PwC’s league table for assets under management on June 30th 2016. Both companies have the highest rating from Fitch (RSS1 and CSS1) and S&P’s (strong). The two companies will remain separated but will benefit from synergies.

Following the acquisition of Italfondiario in 2016, the doBank Group became the largest servicer specialized in the management of non-performing loans, with Euro 81 billion (in terms of gross book value) of loans under management as of December 31, 2016, more than 50% of the volume of the non-performing loans under management in the Italian independent servicing market and equal to approximately one-third of the total volume of non-performing loans in that market.