AC Milan soccer team made its own debut on the fixed income market last Friday May 26th listing two bonds on the Wiener Boerse for total value of 128 million euros, both paying a 7.7% fixed coupon and maturing in 18 months.

A Series 1 bond has been issued for 73.7 million euros, while a Series 2 bond has been issued for 54.3 millions. Proceeds from the first bond will be used to repay the oustanding debt while proceeds from the second bond will be used to finance shopping of new soccer players for the team. AC Milan was advised by Studio Gattai, Minoli, Agostinelli & Partners law firm for the deal.

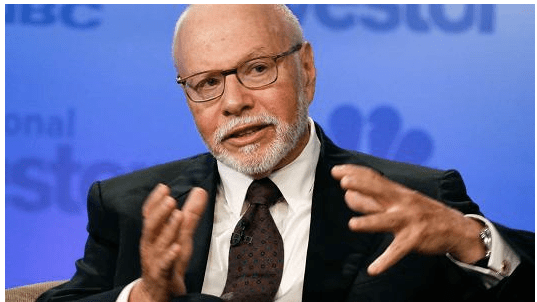

The two bonds were entirely subscribed by Paul SInger‘s Elliott Fund (through the spv Project Redblack) and are part of a 303 million euros financing package that the fund has issued to the new AC Milan’s owner, the Chinese broker Yonghong Li, for acquiring the soccer team. The remaining 175 million euros are instead an 18 months loan issued to Rossoneri Lux and paying an 11.5% fixed coupon. All that after last April Yonghong Li had acquired the company for a 520 million euros equity value or a 740 million euros enterprise value, including 150 million euros of banking debt and a 100 million euros capital increase (see here MF Milano Finanza).

Wiener Boerse in a note said that Italian corporate bond issuers have been quite active recently with 53 bonds listed on the Wien market for a total gross value of more than 6.2 billion euros, including issues by Barilla, Davide Campari, L’Epresso, Snam and Buzzi Unicem.