Italy’s space propulsion company Avio is listing today on the Italian Stock Exchange after the business combination with the Spac (Special purpose acquisition company) Space 2 (see here the press release).

Italy’s space propulsion company Avio is listing today on the Italian Stock Exchange after the business combination with the Spac (Special purpose acquisition company) Space 2 (see here the press release).

Previous Avio’s shareholders were the private equity firm Cinven with an 81% stake, Italy’s aerospace group Leonardo-Finmeccanica with 14% and the managers led by ceo Giulio Ranzo.

In view of the deal Space 2, Leonardo and the managers founded the newco In Orbit spa, which bought all Avio’s shares that were not already owned by Leonardo or an 85.68% stake for a 137 million euros price tag on the basis of a 160 million euros equity value for Avio. Which meant a 230 million euros enterprise value for the group or 6,5x 2015 adjusted ebitda.

Last April 4th the Italian Financial Authority Consob gave its go-ahead for Avio to list its shares andmarket warrants on the Satr segment of the Italian Stock Exchange.

At the Prospectus date (March 31st), Avio’s capital was owned by Space2 (53.15%) , Leonardo (41.22%) and In Orbit (5.64%). After the merger of Avio into Space2 and after Space 2 has been renamed Avio, Avio is now owned by Leonardo witha a 28.29% stake, Space Holding (Spaces2’s promoters holding) with a 3.80% stake, In Orbit with 3.87% and actual Space2’s shareholders (other than Space Holding) with a 64.04% stake.

Space 2, promoted (through Space Holding) by Sergio Erede, Gianni Mion, Roberto Italia, Carlo Pagliani and Edoardo Subert, had raised 308 million euros from investors and is now investing in Avio just a half of its capital. So the remaining liquidity will be brought to a new Spac, named Space 3, which is to be spun off from Space 2 (see here a previous post by BeBeez).

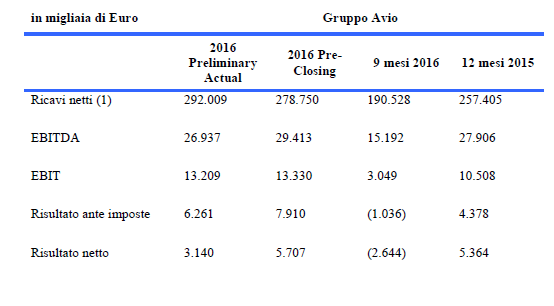

Led by ceo Giulio Ranzo, Avio is global leader in satellite launchers. Avio’s prospectus explains the group had reach 257 million euros in revenues in 2015, with a 27,9 million euros ebitda and a 5,4 million euros net profit 2015 with a 905 million euros orders backlog and a 34.1 million euros net financial debt. It also said that preliminary revenues in 2016 were 292 million euros, with a 26.9 million euros ebitda, a 3.1 million euros net profit and a 18.6 million euros net debt. All that after 24.5 million euro investments.