Unieuro electronics apparel retail chain will list tomorrow on the Italian Stock Exchange with a 220 million euros market capitalization, after ipo had closed last March 30th at 11 euros per share, rather lower than the minimum price of the proposed 13-16.5 euros per share (see the press release here and the press release integration).

Unieuro electronics apparel retail chain will list tomorrow on the Italian Stock Exchange with a 220 million euros market capitalization, after ipo had closed last March 30th at 11 euros per share, rather lower than the minimum price of the proposed 13-16.5 euros per share (see the press release here and the press release integration).

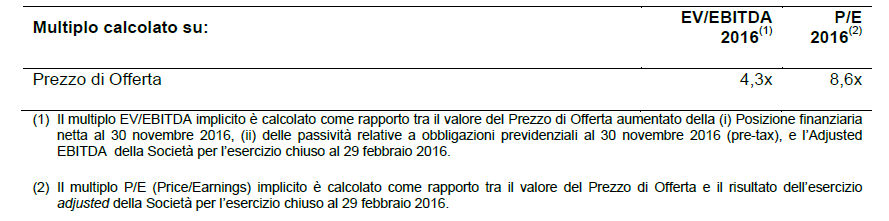

The issue price has been calculated on the basis of an enteprise value of 4.3x FY 2015-2016 ebitda for the group, taking into consideration net financial indebtness at the end of last November 2016.

FY 2015-2016 had closed on February 29th 2016 with 1.57 billion euros of consolidated revenues, 59.1 millions of adjusted ebitda and a net profit of 10.6 millions, while the group had 26 million euros of net financial debt. At the end of last November net financial debt was 25.4 million euros with an adjusted ebitda of 38.1 million euros (see here a previous post by BeBeez).

The company is controlled by the unique shareholder Italian Electronics Holdings, which is in turn controlled by Rhône Capital II (with a 70.5% stake), by Dixons Retail (about 15%), by the Silvestrini family (9,88%) and the management and will have a 31,8% floating capital (or 35% after the greenshoe option has been completely exercised), as the shareholder decided to sell just abput 6.4 million shares that are less than the 8.5 millionshares originally announced (with a 10% greenshoe). Italian Electronics Holding cashed in 70 million euros from the deal (before fees and brefore the greenshoe option).

Citigroup, Credit Suisse and Mediobanca act as joint global coordinator and joint bookrunner, UniCredit is bookrunner and Mediobanca is also sponsor and specialist. Legal advisors to Unieuro and its unique shareholder were Nctm and Latham & Watkins, while Linklaters supported the banks. The auditor is Kpmg.