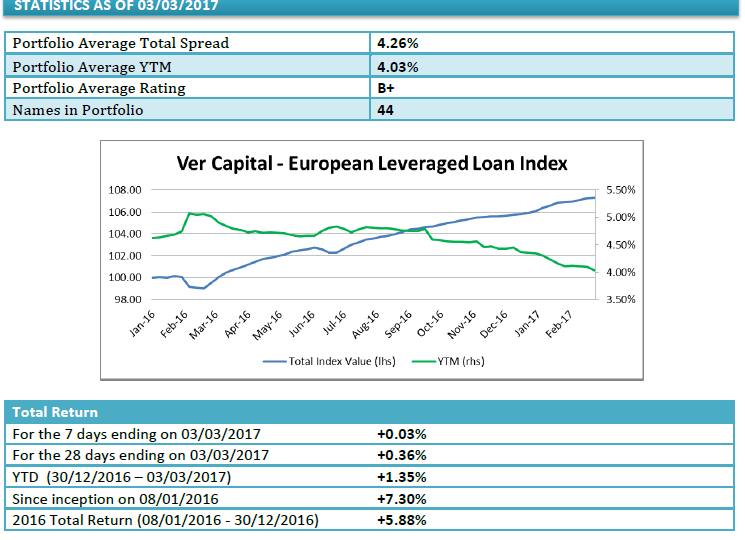

A euro-denominated leveraged loan issued in support of a leveraged buyout by a private equity firm with a 5-7 years’ maturity paid a 4.03% yield on Feb 17th (down from 4.09% on Feb 10th but well down from 5.1% one year ago) and a 1.35% year-to-date total return (from 5.88% in the whole 2016). These are the figures that emerge reading the Ver Capital Leveraged Loan Index, an index that Ver Capital sgr has specifically built for BeBeez and that will be updated weekly.

The Ver Capital Leveraged Loan Index has 44 member loans (all senior secured performing loans with a B+ avarage rating) well diversified among a series of sectors as showed in the information memorandum.

The best performer loan on a weekly total return basis was the one relating to Esmalglass (+0.21%), a leading global supplier of key intermediate products for the ceramics industry since 2012 controlled by Investcorp (who bought it out from 3i) and owner of the Spanish producer Fritta since 2015 (bought from Nazca Private Equity).

The wrost weekly performance was instead the one relating to Armacell (-0,46%), the leading global manufacturer of flexible foam products for equipment insulation and technical applications that Blackstone e Kirkbi (holding di investimento della famiglia Kirk Kristiansen, proprietaria del 75% della Lego) bought in November 2015 from Charterhouse for 960 million euros. All that after a 0.03% weekley total return performance of the whole portfolio.