Banca Farmafactoring spa, the leading player in Europe in the management and nonrecourse factoring of receivables towards the public administrations, filed yesterday to Borsa Italiana its request for admission to trading its shares on the Italian Stock Exchange and asked Italian Markets Supervision Authority Consob its go-ahead to ipo documents ( see here the press release). Last December 23rd Consob already approved the registration document,

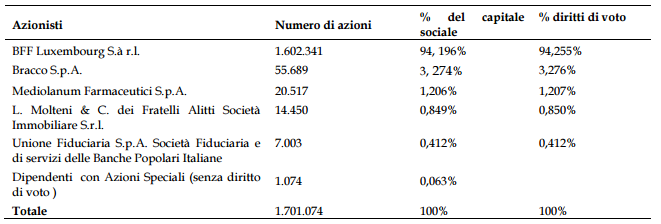

The ipo will be reserved solely to qualified investors with major shareholder BFF Luxembourg sarl (owned by Centerbridge private equity firm) selling part of its 94.196% stake. A maximum of 31.16% of BFF’s capital will be sold (or a maximum of 35.83% if the greenshoe option is exercised). The rest of BFF’s capital is today owned by pharma industries Bracco (3,28%), Mediolanum Farmaceutici and La Molteni and by fiduciary trust company Unione Fiduciaria.

Last February BFF issued 100 million euros of subordinated bonds in a private placement (see here a previous post by BeBeez). In 2016 BFF Banking group recorded +24% increase in net banking income to 176 million euros from 142 millions in 2015. Its adjusted net profit was 88 million euros and the CET1 ratio for the banking group at year end 2016 was 16.7%.

BFF group was said to be valued about 500 million euros when Centerbridge bought out the group in Spring 2015.