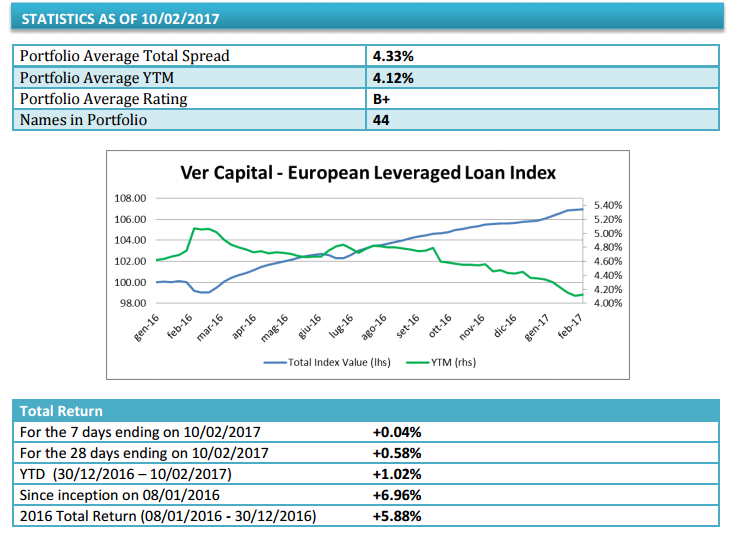

A euro-denominated leveraged loan issued in support of a leveraged buyout by a private equity firm with a 5-7 years’ maturity pays a 4.33% (up from 4.11% one week ago but well down from 5.1% one year ago) and a 1.02% year-to-date total return (from 5.88% in the whole 2016). These are the figures that emerge reading the Ver Capital Leveraged Loan Index, an index that Ver Capital sgr has specifically built for BejiBeez and that will be updated weekly.

The Ver Capital Leveraged Loan Index has 44 member loans (all senior secured performing loans with a B+ avarage rating) well diversified among a series of sectors as showed in the information memorandum.

The best performer loan on a weekly total return basis was the one relating to Linxens (+0.25%), a French technology company designing and manufacturing smart card connectors which had been acquired by CVC Capital Partners in July 2015 for 1.5 billion euros.

The wrost weekly performance was instead the one relating Mauser (-1.35%), a supplier of industrial rigid packaging products and reconditioning services sold to Stone Canyon Industries from Clayton, Dubilier & Rice a few days ago in an all-cash deal valued at 2.3 billion dollars. All that after a 0.04% weekley total return performance of the whole portfolio.