Italy’s eyewear maker Marcolin listed its new 250 million euros bond on the ExtraMot Pro market. The new bond is maturity in February 2023 and pays a 3 -months euribor plus 423 bps floating rate coupon.

The deal is part of a more complex agreement including the announced joint venture with French luxury giant Lvmh, who is buying a 10% stake in Marcolin’s capital and is actually founding a new company that could eventually absorb all of Lvmh’s eyewear licenseses.

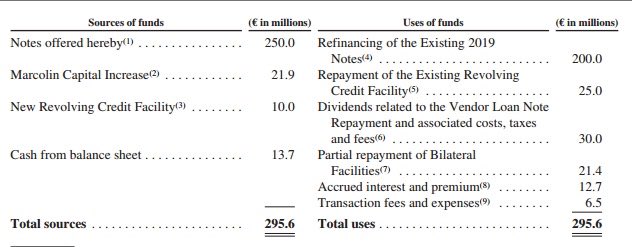

The deal is aimed at refinancing the existing debt and repaying a vendor loan as explained in the Offering Memorandum of the bond. Marcolin listed a 200 million euros bond on the ExtraMot Pro market in 2013, maturing in November 2019 and paying an 8.5% fixed coupon. The bond is to be repaid today.

Marcolin had been delisted from the Italian Stock Exchange in 2012 following a tender offer by funds managed by Pai Partners.