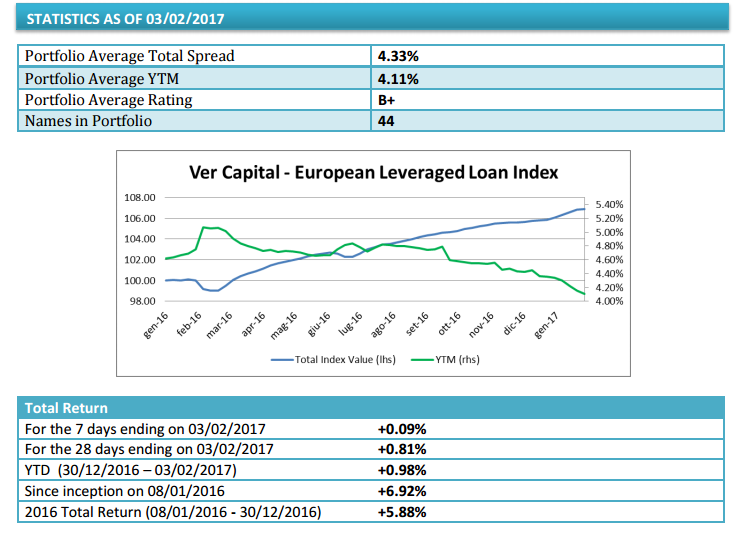

A euro-denominated leveraged loanissued in support of a leveraged buyout by a private equity firm with a 5-7 years’ maturitypays a 4.11% (slightly down from 4.16% one week ago) and a 0.98% year-to-date total return (from 5.88% in the whole 2016). These are the figures that emerge reading the Ver Capital Leveraged Loan Index, an index that Ver Capital sgr has specifically built for BeBeez and that will be updated weekly.

The Ver Capital Leveraged Loan Index has 43 member loans (all senior secured performing loans with a B+ avarage rating) well diversified among a series of sectors as showed in the information memorandum.

The best performer loan on a weekly total return basis was the one relating to VWR (+0.57%), a global laboratory supplier and distributor of chemicals, life science products which was sold by German pharma group Merck to Clayton, Dubilier & Rice which in turn sold it to Madison Dearborn Partners in 2007. The company was then listed in New York in 2014 which Madison still owning a stake.

The wrost weekly performance was instead the one relating HotelBeds (-0.31%), the largest business globally sellling hotels rooms to wholesale customers such as travel agencies and tour operators which German tour operator TUI sold last April to Cinven’s funds and Canada Pension Plan Investment Board in a 1.165 billion euros deal. All that after a 0.09% weekley total return performance of the whole portfolio.