Enpam, Italian medicians and dentists’ pension fund, bought a 50% stake in Principal Place, the site where Amazon is going to move its London headquarters. The deal has been signed by a real estate fund subscribed by Enpam and managed by Antirion sgr . The seller is Brookfield Property Partners, who remains the owner of the other 50% stake.

Enpam, Italian medicians and dentists’ pension fund, bought a 50% stake in Principal Place, the site where Amazon is going to move its London headquarters. The deal has been signed by a real estate fund subscribed by Enpam and managed by Antirion sgr . The seller is Brookfield Property Partners, who remains the owner of the other 50% stake.

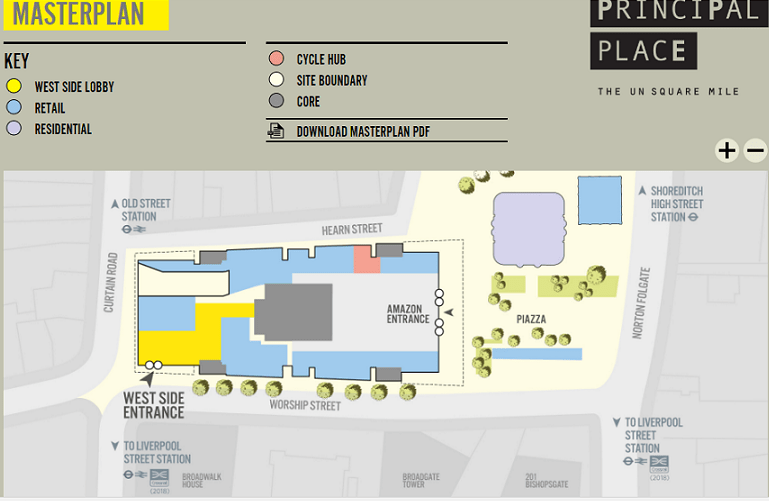

Brookfield Property Partners said the 621,000sqft building, which will be occupied by Amazon next year, is worth 763 million pounds(or 886 million euros). The building is part of a mixed-use complex, including a 50-storey residential tower and 20,000sqft of retail space (see here IPE Real estate ).

Enpam paid 245,7 million euros for its stake in Principal Place, Il Sole 24 Ore wrote and the agreement includes a 15 years lease contract for a 4.5% annual yield. Amazon moved already some of its 4,500 employees in the new site and is investing about 40 million euros in property customization.

Antirion sgr, led by ceo Giorgio Pieralli, actually manages for Enpam five different real estate funds owning buildings such as French insurance company Axa’s headquarters in Milan or some luxury hotels once onwed by the Ligresti family such as the Tanka Village in Sardinia or the Executive Hotel in Milan.

Enpam is unique or major subscriber of three real estate funds: the Ippocrate fund managed by Idea Fimit sgr, the Antirion Global fund (core sector and hotel sector) and the Antirion Aesculapius fund, both managed by Antirion sgr.