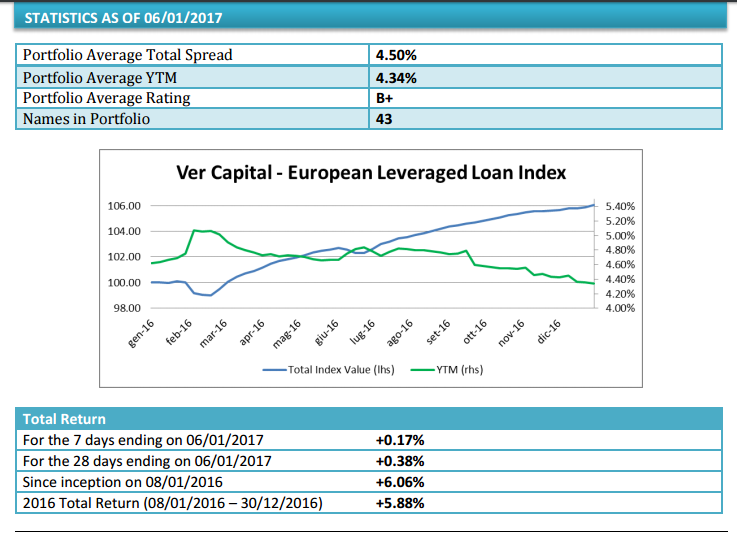

A euro-denominated leveraged loan issued in support of a leveraged buyout by a private equity firm with a 5-7 years’ maturity pays a 4.34% yield (fslightly down from 4.36% last week) and a 0.17% year-to-date total return (from 5.88% in the whole 2016).

These are the figures that emerge reading the Ver Capital Leveraged Loan Index, an index that Ver Capital sgr has specifically built for BeBeez and that will be updated weekly.

The Ver Capital Leveraged Loan Index has 43 member loans (all senior secured performing loans with a B+ avarage rating) well diversified among a series of sectors as showed in the information memorandum.

The best performer loan on a weekly total return basis was the one relating to Hotelbeds (+0,87%), the largest business globally sellling hotels rooms to wholesale customers such as travel agencies and tour operators which German tour operator TUI sold last April to Cinven’s funds and Canada Pension Plan Investment Board in a 1.165 billion euros deal.

The wrost weekly performance was as well as last week the one relating to Orion Engineered Carbons (-0.09%), a German black carbon producer owned by Rhone Capital and Triton Partners and listed on the German Stock Exchange in 2014.