Italy’s casualwear maker Stefanel asked the Treviso Court for creditor protection yesterday (in the form of “concordato preventivo in bianco o con riserva” on the basis of art. 161, 6° co of Italy’s Bakrupcty Law). A similar request has been delivered by Stefanel’s shareholder Finpiave, owning a 20.3% stake in the company (see here the press release). The formal step with the Court follows a decision by Stefanel’s Board last Wednesday (see here the press release).

The decision is aimed at submitting to the Court a debt restructguring agreement with the senior lending banks on the basis of art. 182-bis of Italy’s Bakrupcty Law which will include injection of new equity finance by a new investor. That is why the dossier is already on the desk of turnaround specialists such as Pillarstone Italy, Idea Credit Recovery, Oxy Capital Attestor Capital or the Cassa Depositi e Prestiti-sponsored turnaround fund. However it is still possible that newcomers decide to enter the Italian market such as Gordon Brothers or that some indsutrial groups such as BasicNet decide to bet on the company, as il Sole 24 Ore wrote yesterday. Rothschild has been appointed advise Stefanel on this process.

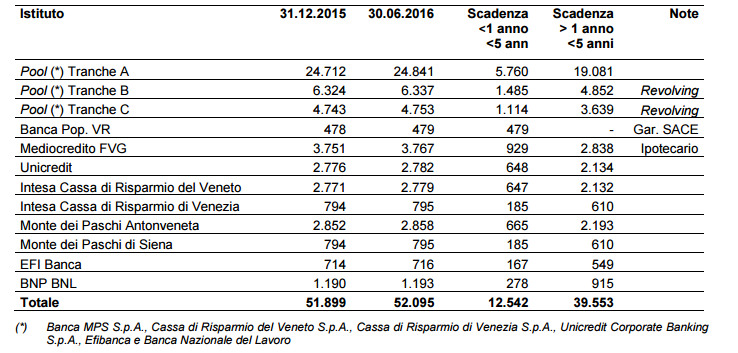

Senior lender banks to Stefanel are Bnl-Bnp Paribas, Banco Popolare, Intesa Sanpaolo, Mps and Unicredit with a total 52 million euros short and medium term facilities. (see the table above from H1 2016 Interim report, page 52).

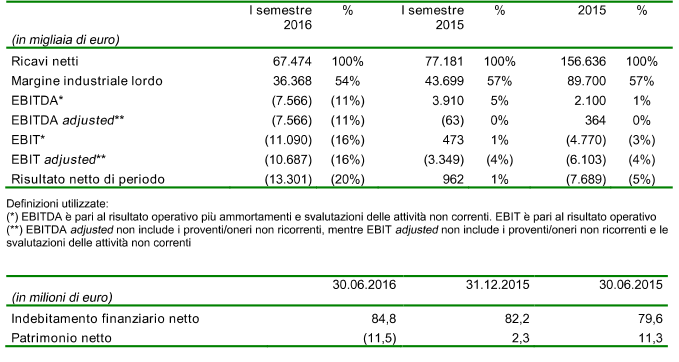

The Interim report dated August 1st already stated that the group had breached financial covenants on its debt following a debt restructuring agreement signed in June 2014 and that the situation requested new equity in order to find a new financial equitlibrium.

That is why the company had decided last March to review the 2014 Agreement with the banks and asked its lenders a standstill agreement till next December 31st.

Founded in 1959 by Carlo Stefanel as Maglificio Piave and then renamed as Stefanel in 1980, the company has been listed on the Italian Stock Exchange since 1987. stefanel is today controlled by Giuseppe Stefanel and counts 1.147 employees in 550 shops, 150 of which being out of Italy.

Stefanel reached 67.4 million euros in revenues in the six months ended on June 30th, with a negative ebitda of 7.6 millions and a net loss of 13.3 millions, having a net financial debt of 84.8 millions. The group had ended year 2015 with 156-6 million euros in revenues, a positive ebitda of 2.1 millions, a 7.7 million euros net loss and a net financial debt of 82,2 million euros.