Guala Closures spa appointed Credit Suisse, Banca Imi, Barclays and JPMorgan as joint bookrunners of a new 500 million euros senior secured bond issue with a 5 years maturity non callable for one year, MF Milano Finanza writes today.

The Italian group, a global leader globale in the production of security closures for the spirits and beverage industry, will use proceed from the bond to finance a tender offer on two previous bonds and to partly repay its 75 million euros revolving facility (see here the press release).

More in detail, GCL Holding sca (the parent company of Guala Closures spa) is tendering 200 million euro bonds maturing in 2018 and paying a 9.375% fixed coupon at a 102.344 price while Guala Closures spa will buy at par 275 million euro bonds maturing in 2019 and paying a floating rate coupon equal to euribor 3 months rate plus 537.5 basis points. Both tender offers will expire next Nov. 10th (see here the press release).

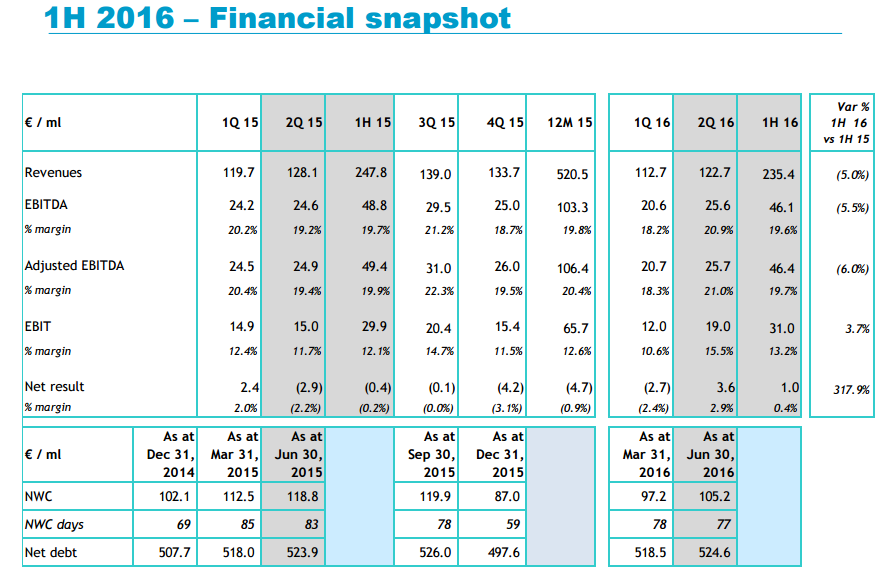

The interim consolidated H2 2016 results for GCL Holding sca show that the group ended the six months to June 30th with 235.4 million euros of revenues (from 247.8 million on June 30th 205 and from 520,5 million in FY 2015), with a 46.4 million euros adjusted ebitda (respectively from 49.4 and 106.4 millions) and a net financial debt of 524.6 millions (from 523.9 and 497.6 millions). Guala Closures spa stand-alone had reacdhe 124.3 million euros inrevenues in 2015 ( see here an analysis by Leanus, after free registration).

Guala Closures had been listed on the Italian stock Exchange in Novembre 2005 and was delisted in 2008 after a tender offer by Dljmb Overseas Partners IV, a private equity managed by Dlj Merchant Banking, which was controlled by Credit Suisse Group (see an old Reuters here) and which spun-off from Credit Suisse in 2014 and renamed aPriori Capital Partners.

Intesa Sanpaolo had acquired a 20% stake in GCL Holdings sarl (the parent company of GCL Holdings sca) in 2008 and transferred its stake to Melville srl, of which in turn NB Reinassance Partners Holdings sarl bought a 72% stake (see here H1 GCL interim report, page 52). NB Reinassance Partners Holdings sarl is the new private equity fund sponsored by Intesa Sanpaolo e Neuberger Berman (see here a previous post by BeBeez). Today Melville owns a 19-2% stake in GCL Holdings sarl, while aPriori Capital Partners’ managed funds own a 58% stake in GCL Holdings sca through a 35.4% stake in GCL Holdings sarl.

Back in 2008 Guala Closures’ managers led by chairman and ceo Marco Giovannini had reinvested in GCL Holdings sarl. The 2008’s deal was financed by Unicredit, Intesa Sanpaolo e Natixis.