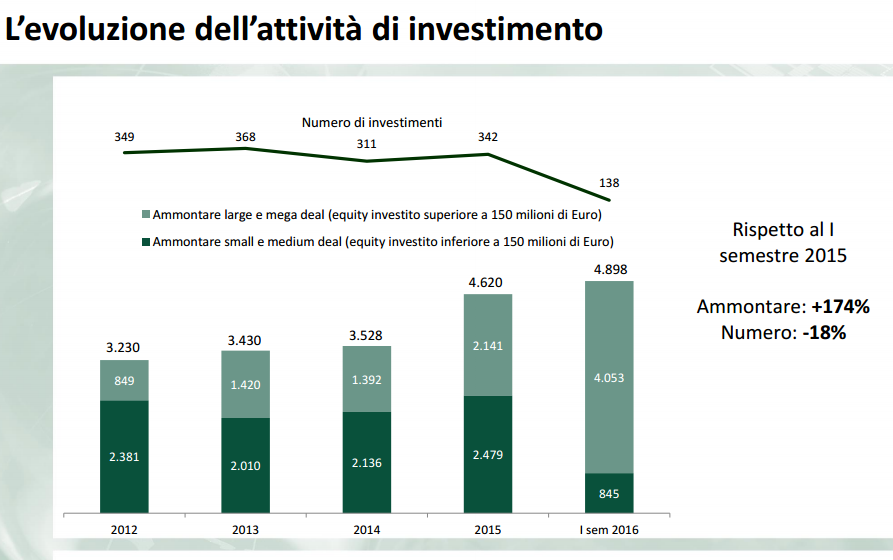

Eleven big deals (ranging from 150 million euros in equity investment or over) have been ruling the Italian private equity market in Italy in H1 2016 as those deals topped a total of 4.05 billion euros together out of 4.9 billion euros for the entire market.

Eleven big deals (ranging from 150 million euros in equity investment or over) have been ruling the Italian private equity market in Italy in H1 2016 as those deals topped a total of 4.05 billion euros together out of 4.9 billion euros for the entire market.

Smaller deals reached just 800 million euros in H1 2016, while they were 1.3 billion euros in H1 2015. Data were delivered yesterday by AIFI, the Italian Association for Private Equity, Venture Capital and Private Debt.

As for size of the target companies, businesses below 50 million euros in revenues still prevail as they count for a 70% in the number of closed deals (138). Ict sector is the most represented with 27 deals (or 19%), industrial goods and services (17%) and manufacturing (14%) follow. The most tageted companies are always based in Northern Italy (103 delas or 79%).

Coming back to the 4.9 billion euros figure, this is a good sign anyway as it is a record for activity in a semester in Italy and compares with 4.62 billion euros investedby private equity funds in the whole 2015 (or just 1.8 billion euros in H1 2015) . That’s why Francesco Giordano, a partner at PwC Transaction Services. said that “Italy was able to attract significant investments from many international players who are always quite interested in the Italian entrepreneurs’ business model”.

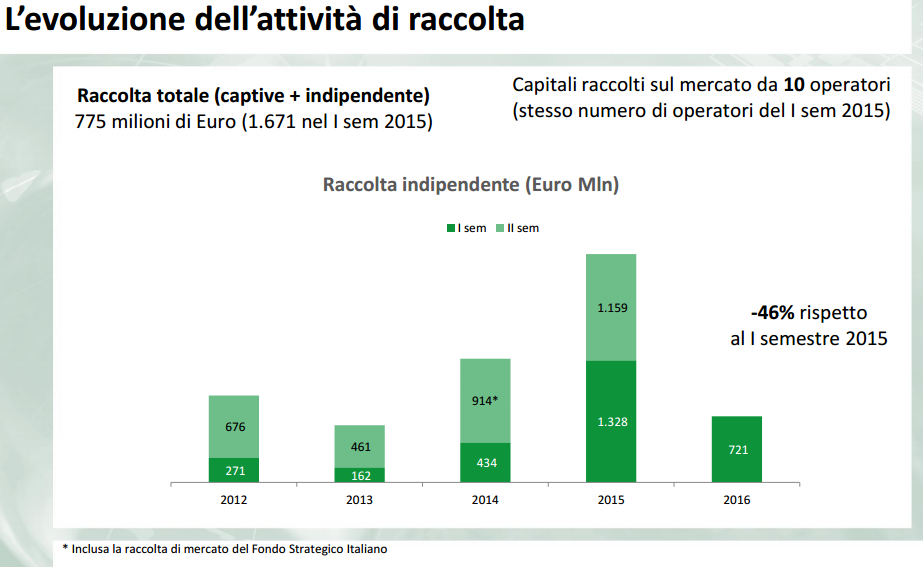

However both Aifi’s chairman Innocenzo Cipolletta and Aifi’s general maanger Anna Gervasoni stressed that Italy might see many more private equity deals on SMEs if Italian private equity funds focused on Italian SMEs were many more as it happens in France. Over there private equity funds invested 5,5 billion euros in French companies in 1,040 different deals which means that the deal size has been much more lower than in Italy in the period and this is because French private equity firms were able to attract huge capitals from investors: 6.3 billion euros in H1 2016.

This is a figure much higher than the 721 million euros raised by Italian private equity firms in the same period (just couinting the independet fundraising), while Italian private equity funds had raised 1,3 billion euros in H1 2015. thanks to the final closing of three big funds that represented about 90% of the all capital raised.

This is a figure much higher than the 721 million euros raised by Italian private equity firms in the same period (just couinting the independet fundraising), while Italian private equity funds had raised 1,3 billion euros in H1 2015. thanks to the final closing of three big funds that represented about 90% of the all capital raised.

As far as the sources of capital, the Italian domestic fundraising is still prevailing with 388 million euros (or 54%). Funds of funds and family offices have been the major source of capital (63%), while insurance companie and pension funds are still lagging behind.