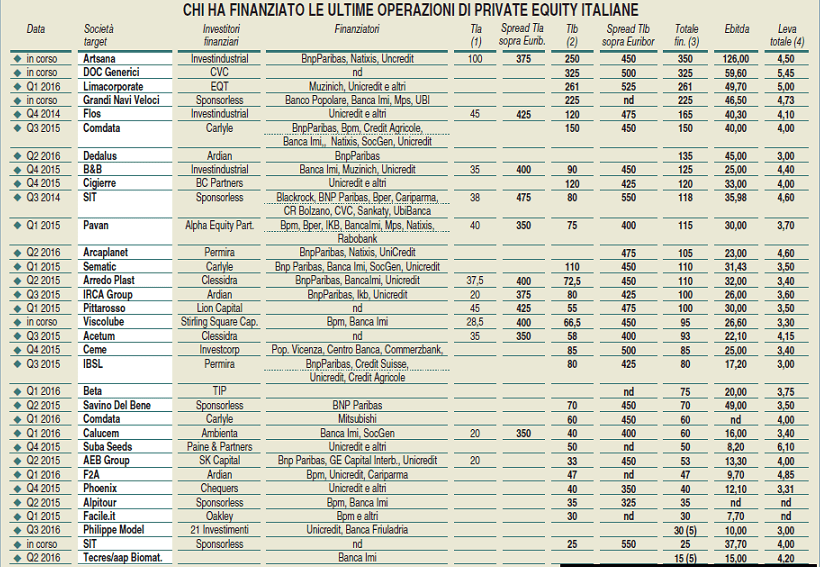

Leveraged loans financing private equity firms’ deals on Italian targets yield about 450-500 basis points above 3 months euribor rate. Which is quite a good yield in the European zero-rates panorama.

Mathieu Chabran, co-founder of Tikehau Capital (together with Antoine Flamarion) said to MF Milano Finanza that “this is quite an interesting asset class for institutional investors with a long term prudent perspective”, adding that “our funds invest in senior loans, which are less risky if the issuer defaults. They are euro denominated and secured by issuer’s shares, cash deposits or real estate. They also pay a floating rate which is not significantly impacted by market interest rates’ volatility and have a 5 years average duration. They are classified as sub-investment grade credits and pay yields about 450-500 basis points above 3 months euribor which is more than 10x a yield paid by a 5 years maturity Italian Btp (which paid a 0.36% yield last Friday Oct. 14th)”.

Closed-end credit funds are used to buy the term loan bullet facility (capital is reimbursed in one shot at maturity) of a syndacated leveraged loan while banks prefer the term loan amortizing facility (capital is reimbursed in tranches during the loan life). Syndacated loans involing credit funds are generally issued to support acquisition of companies reaching 50 million euros in ebitda or more. If ebitda is 20 millions or less banks use to finance acquisitions by themselves without a syncation to credit funds. As for ebitda in the middle of this range, it’s a deal-by-deal matter.

As for the liquidity issue, on the primary market a deal takes about 10-15 days to be finalized while on the secondary market there is no rule.

As for the investors, “Italian insurance companies and pension funds are less used to such kind of investments”, head of Tikehau Capital’s Milan office Luca Bucelli told MF Milano Finanza, adding that “we see a good interest from them and believe that we might see in italy what we have seen in France four years ago, when we launched our first leveraged loans funds. They were cloased-end funds which are helpful to avoid selling part of your portfolio just because some of your investors want to realize their investments when the market is against you. This kind of funds are quite interesting for insurance companies as Solvency 2 capital requirements are low: an investor is told exactly which is the underlying protfolio of the fund, so the weighted average capital may be associated to each single underlying loan”.

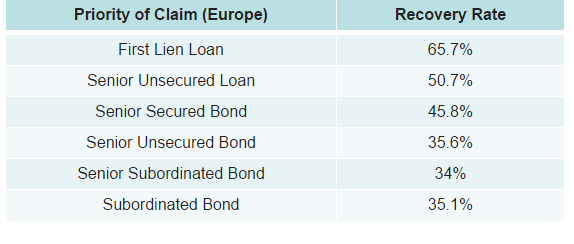

As for the default risk on this investment, this is quite limited ad the average default rate is abour 2.1% with a recovery rate above 60%. Barbara Pastorelli, an investment analyst at Ver Capital sgr, told MF thanks to the security package associated to these loans, to their seniority and presence of covenants”. This revory rate compares to a 45% rate for European high yield secured bonds and to a 35% rate for European high yield unsecured bonds.

“Summing up, senior leveraged loans are the ideal choice for investors who want to be exposed to European corporate debt optimizing the risk-return ratio thanks to lower volatility, major contractual guarantees and a floating rate coupon which results ina lower market risck than other fixed income securities, Mrs. Pastorelli said.