Private equity and asset management firms circle again Pioneer Investments, after agreements between Unicredit, Banco Santader, General Atlantic and Warburg Pincus had been terminated last July (see here a previous post by BeBeez), Il Sole 24 Ore wrote naming Advent International, CVC Capital Partners and Amundi as working on the deal.

Unicredit’s press release last July explained that “further to Unicredit’s announcement on 11 July 2016 of a group-wide strategic review, the results of which will be communicated to the market before the end of 2016, Pioneer will now be included in the scope of the strategic review to explore the best alternatives for all Pioneer stakeholders including a potential ipo. This is to ensure the company has the adequate resources to accelerate growth and continue to further develop best-in-class solutions and products to offer its clients and partners”.

So Unicredit’s ceo Jean Pierre Mustier appointed JP Morgan as financial advisor and Gianni Origoni Grippo Cappelli as legal advisor on the Pioneer’s dossier.

At the end of July 2014 the Santander-General Atlantic-Warburg Pincus consortium’s bid had been preferred to other two bids selected in a short list: the one by Advent International and the one by CVC Capital Partners in consortium with GIC-The Government of Singapore Investment Corporation (see here a previous post by BeBeez).

Expressing interest for Pioneer are also international asset managers as the French group Amundi, which has been looking to strengthen its market position in Italy and Europe for a while. Amundi is actually one of the bidders for Arca sgr, an Italian asset management company owned by a number of Italian cooperative banks which has been on sale for some months. However the sale process has been put in a stand-by mode waiting for a choice on the issue by the Atlante fund, managed by Quaestio Capital Management sgr, the new controlling entity of two of the main shareholders of Arca, who are Banca Popolare di Vicenza and Veneto Banca (together they own a 40% stake) (see here a previous post by BeBeez).

Market rumors told about a possibile interest to acquiring Pioneer by Generali insurance group, but a spoke person from Generali said that an interest to the Pioneer dossier is not in the cards. The same story comes about a possibile integration between Pioneer and Eurizon Capital (the asset manager of the Intesa Sanpaolo group). “I do not have anything about an Eurizon-Pioneer dossier on my desk”, Intesa Sanpaolo’s chairman, Gian Maria Gros-Pietro, said to the Italian press at the Ambrosetti workshop in Cernobbio (Como) last weekend.

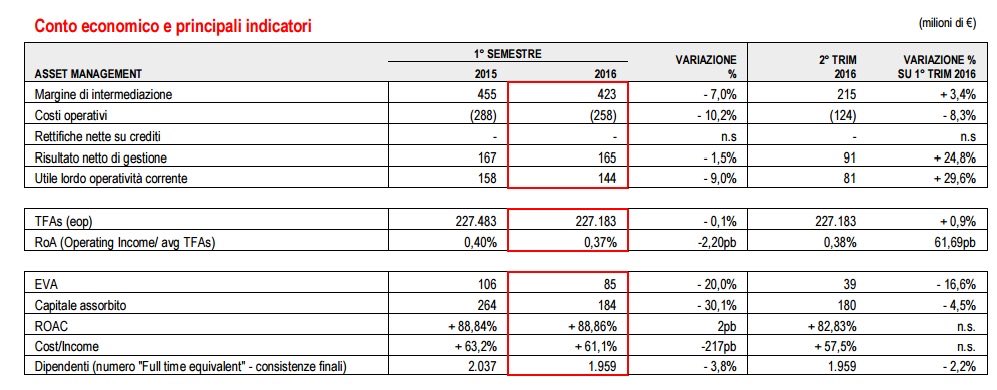

As for the Santader’s agreement, Pioneer had been valued 2.75 billion euros, including debt, that was just a bit more than 10x Pioneer’s expected year 2014 ebitda (about 270 million euros). On June 30th 2016 Pioneer had assets under management for 220.7 billion euros and the consolidated H1 2016 Unicredit group’s results (see page 28) shows a 165 million euros ebitda (from 311 millions at the end of 2015) and a 423 million euros net banking income (from 919 millions).