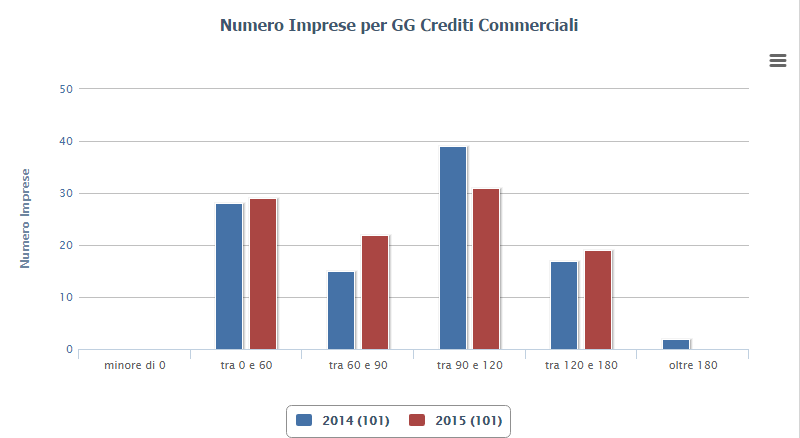

Here you’ll find the way to reach a selection of 101 potential Italian industrial SMEs issuers minibond, a perfect target for private debt funds. The selection was made by setting criteria to identify the existence, on the one hand, of stable or growing revenues with discrete margins and good capacity of working capital management generating cash flow from operations; and on the other, the low availability of liquidity due to cyclical and not structural elements. The results of the selection are companies with revenues between € 20 and €200 million, with an EBITDA of at least € 3,000,000 and at least 7% of revenues and a debt / EBITDA ratio lower than 5. These criteria, are traditionally used to identify SMEs financially solid. But to these criteria, others have been added, aimed at identifying companies with clear financial need and likely ability to generate cash sufficient to meet its commitments: average time of collection and inventory management of less than 170 days, Leanus Score minor than 3 (algorithm that measures the economic balance, balance sheet and financial performance of the companies; the balance is perfect above 3), operating cash flow of at least one million euro. The selection was conducted on Leanus database, business information company founded by Alessandro Fischetti and Stefano Carrara, and the aggregate results are available online at www.facciamoparlareibilanci.com, once you have registered for free. The same exercise was conducted in early August to determine the position of the 101 SMEs perfect target for private equity funds. Considering the resulting 101 SMEs potential issuers minibond, as many as 42.6% are based in Lombardy (43), 12.9% of the companies in Veneto (13), Tuscany (8), Piedmont (8) . At the tail end Campania with two (2) companies, Liguria (2) and Sicily (1). The average revenues is € 52.2 million with an increase of 9.0% from 2014. 30 companies have increased their turnover by more than 10%. The working cycle is on average equal to 77 days and the operating cash flow is always greater than one million euro with low available liquidity (2.13% of sales). To have a rather detailed list of the companies in question, just register for free on www.facciamoparlareibilanci.com site and then activate the Premium profile, by clicking on “Strumenti” in the top bar and then “Upgrade Profilo Premium”. Click here to find out the advantages and discounts for the BeBeez users. The overall profile of the companies that meet the criteria considered to be included among the potential targets for minibond fund is likely to be attractive for any traditional finance provider with a big competition between funds and banks, particularly now, with the italian banks rich in cash. In fact, if on one hand the instrument of minibond was created to facilitate the access to credit for companies in temporary difficulty and thereby obliged to look for alternative solutions to traditional credit, the search parameters used by private debt funds are identical, sometimes more selective, if compared with those used by banks and financial institutions. The result is that, except in exceptional cases, the hunt has always the same prey: good companies (not very interested in finance, but sometimes only searching a higher visibility) or companies in mild financial stress that can now choose from the various instruments (including minibond) made available by the financial system.

Here you’ll find the way to reach a selection of 101 potential Italian industrial SMEs issuers minibond, a perfect target for private debt funds. The selection was made by setting criteria to identify the existence, on the one hand, of stable or growing revenues with discrete margins and good capacity of working capital management generating cash flow from operations; and on the other, the low availability of liquidity due to cyclical and not structural elements. The results of the selection are companies with revenues between € 20 and €200 million, with an EBITDA of at least € 3,000,000 and at least 7% of revenues and a debt / EBITDA ratio lower than 5. These criteria, are traditionally used to identify SMEs financially solid. But to these criteria, others have been added, aimed at identifying companies with clear financial need and likely ability to generate cash sufficient to meet its commitments: average time of collection and inventory management of less than 170 days, Leanus Score minor than 3 (algorithm that measures the economic balance, balance sheet and financial performance of the companies; the balance is perfect above 3), operating cash flow of at least one million euro. The selection was conducted on Leanus database, business information company founded by Alessandro Fischetti and Stefano Carrara, and the aggregate results are available online at www.facciamoparlareibilanci.com, once you have registered for free. The same exercise was conducted in early August to determine the position of the 101 SMEs perfect target for private equity funds. Considering the resulting 101 SMEs potential issuers minibond, as many as 42.6% are based in Lombardy (43), 12.9% of the companies in Veneto (13), Tuscany (8), Piedmont (8) . At the tail end Campania with two (2) companies, Liguria (2) and Sicily (1). The average revenues is € 52.2 million with an increase of 9.0% from 2014. 30 companies have increased their turnover by more than 10%. The working cycle is on average equal to 77 days and the operating cash flow is always greater than one million euro with low available liquidity (2.13% of sales). To have a rather detailed list of the companies in question, just register for free on www.facciamoparlareibilanci.com site and then activate the Premium profile, by clicking on “Strumenti” in the top bar and then “Upgrade Profilo Premium”. Click here to find out the advantages and discounts for the BeBeez users. The overall profile of the companies that meet the criteria considered to be included among the potential targets for minibond fund is likely to be attractive for any traditional finance provider with a big competition between funds and banks, particularly now, with the italian banks rich in cash. In fact, if on one hand the instrument of minibond was created to facilitate the access to credit for companies in temporary difficulty and thereby obliged to look for alternative solutions to traditional credit, the search parameters used by private debt funds are identical, sometimes more selective, if compared with those used by banks and financial institutions. The result is that, except in exceptional cases, the hunt has always the same prey: good companies (not very interested in finance, but sometimes only searching a higher visibility) or companies in mild financial stress that can now choose from the various instruments (including minibond) made available by the financial system.

EdiBeez srl