Quaestio Capital Management sgr’s Atlante fund will buy the 1.6 billion euros mezzanine tranche of the projected Banca Monte dei Paschi di Siena’s 9.2 billion euros Npl securitization which was announced last July 29th. The fund will be as well granted warrants to buy a 7% stake in Mps’s capital when a 5 billion euros capital increase will be launched by the end of the year (see here the press release).

Quaestio Capital Management sgr’s Atlante fund will buy the 1.6 billion euros mezzanine tranche of the projected Banca Monte dei Paschi di Siena’s 9.2 billion euros Npl securitization which was announced last July 29th. The fund will be as well granted warrants to buy a 7% stake in Mps’s capital when a 5 billion euros capital increase will be launched by the end of the year (see here the press release).

The news is part of a more complex plan announced by the bank last Friday which actually includes a strengthening in coverage of non-performing exposures (i.e. bad loans, unlikely to pays and past due loans), the de-recognition of the bad loan portfolio (gross 27.7 billion euros or net 10.2 billions on March 31st 2016) through the securitization structure and a 5 billion euros capital increase.

The completion of the transaction is subject, among others, to approval by the relevant supervisory and regulatory authorities. The Bank will submit to the ECB, at the earliest possible date, a comprehensive capital plan including the Rights Issue aimed at obtaining a more than adequate capital position. In this regard, the ECB has confirmed that Mps, subject to all parts of the transaction being successfully completed, will be able to exclude/limit the impact stemming from the disposal of all bad loans as part of the Transaction, for the calculation of loss given default (LGD) estimates.

Banca Mps is supported by JP Morgan and Mediobanca as financial advisors, as global coordinator of the capital increase and as arranger of the bad loan portfolio securitization. Banca Mps is also supported by Lazard as independent financial advisor and by BonelliErede law firm, while professors Piergaetano Marchetti and Francesco Carbonetti are advising the bank, respectively, on company and supervision legal aspects.

As for the timeline, Mps’s ceo Fabrizio Viola told in a conference call last Friday that “the business plan will be presented next September before the capital increase. Next October or November the shareholders’ meeting will vote the whole transaction and by end of the year we will close the capital increase and the bad loan derecognition”. The Here are the details of the proposed transation.

- Increase in the coverage ratios of impaired exposures (i.e. bad loans, unlikely to pays and past due loans) from 63.3% to 67%. The average coverage ratios of unlikely-to-pay (16.9 billion euros gross exposure and 12 billions net exposure as of 31 March 2016 and coverage ratio of 29.1%) and past-due (2.6 billions gross exposure and 1.9 billions net exposure as of 31 March 2016 and coverage ratio of 27.2%) will be increased to 40%. The total amount of the above mentioned measures is estimated at about 1 billion euros for bad loans and about 2.2 billions for the other categories of non-performing loans.

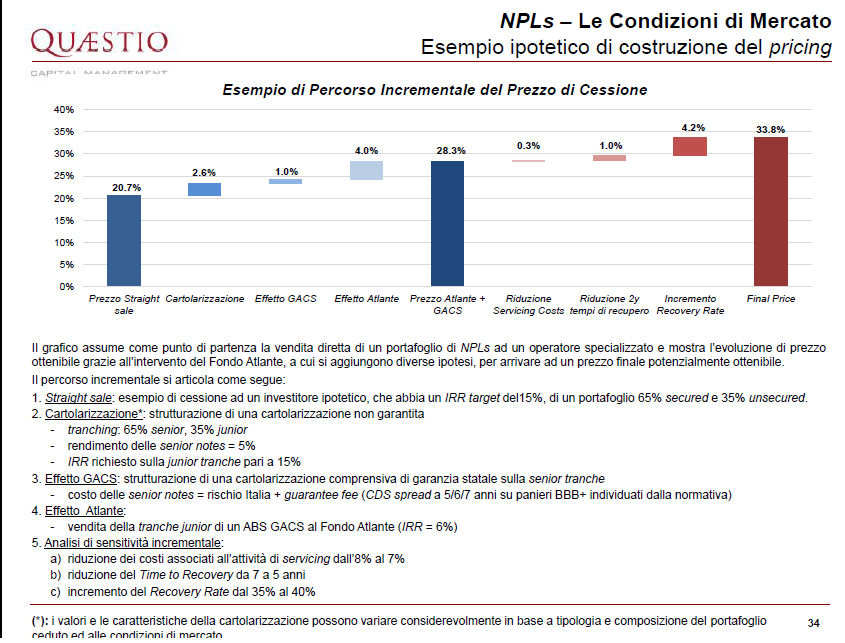

- The BMPS bad loan portfolio will be fully transferred to a securitization vehicle under the Italian law at a price equal to 9.2 billion euros (or 33% of gross book value, corresponding to the net book value of the bad loan portfolio, following the increase in the coverage ratios described above. This is a price which is very close to the one Quaestio Capital Management sgr’s ceo, Alessandro Penati, told he was targeting when he had presented Atlante fund last Spring, see here a previous post by BeeBeez and download here Atlante fund’s presentation: at page 34 you’ll find how a 32.88% acquisition price may be reached). The italian spv will issue senior notes for up to 6 billion euros, to be placed with investors and to be potentially eligible and assisted, for its investment grade component, by the Gacs (Garanzia Cartolarizzazione Sofferenze or a guarantee by the Italian Government); mezzanine notes for up to 1.6 billion euros to be underwritten by the Atlante Fund; junior notes for up to 1.6 billions to be assigned to the shareholders of BMPS, in order to achieve simultaneous de-recognition of the bad loan portfolio from the BMPS balance sheet. It is also expected that the financial instrument to be assigned to existing BMPS shareholders shall be publicly traded.

- Recapitalization of the bank by the end of 2016 in order to restore a solid regulatory capital position for BMPS following the transaction. The Board of Directors of BMPS will convene a General Meeting for the approval of the divisible share capital increase, with pre-emption rights to BMPS shareholders, for up to 5 billion euros and a share capital increase with no pre-emption rights, dedicated to the warrants to be issued to the Atlante Fund, for the subscription of newly issued BMPS shares for 7% of the fully diluted share capital post-completion of the rights issue. J.P. Morgan and Mediobanca, acting as Joint Global Coordinators and Joint Bookrunners, and Banco Santander, BofA Merrill Lynch, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs International, acting as Co-Global Coordinators and Joint Bookrunners have entered into a preunderwriting agreement – subject to standard terms and conditions for transactions of this nature and certain specific conditions related to the positive outcome of the deconsolidation of the bad loan portfolio and of the marketing activities – with the purpose to enter into an underwriting agreement for the subscription of the newly issued shares eventually unsubscribed at the end of the offering for an amount of up to 5 billion euros .

Last July 28th Quaestio Capital Management sgr had presented its management team focused on credit risk and distressed securities analysis and management in view of its coming investments in the non performing loan market (download here the press release).