Schumann spa, the new parent company of Italy’s bets and payment services company Sisal, priced yesterday the announced 725 million euros high yield bond issue(see here a previous post by BeBeez).

The issue is in two tranches: one has a 325 million euros size, hsa a 6 years maturity non callable for one year, pays a floating coupon and yields 662.5 basis points over 3 months euribor; the second tranche ha a 400 million euros size, a 7 years maturity non callble for 3 years and was priced at par with a 7% fixed coupon.

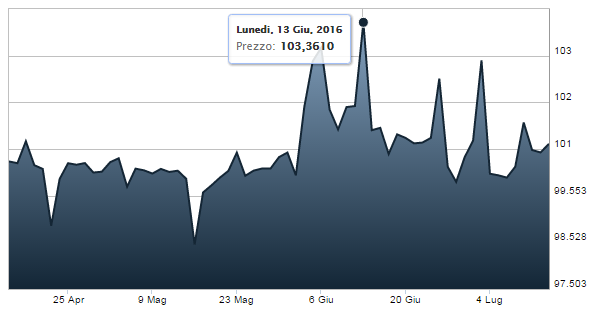

Proceeds from the bond issue will be used to partly fund Sisal’s one billion euros secondary buyout by Cvc Capital Partners (see here a previous post by BeBeez) and refinance Sisal’s debt, included Sisal’s 275 million euros bond listed at the EuroMot Pro market.