London Stock Exchange Group announched yesterday the launch of Elite Club Deal, a new online private placement platform for matching Elite program companies’ requests for private equity and private debt with professional investors (see here the press release).

London Stock Exchange Group announched yesterday the launch of Elite Club Deal, a new online private placement platform for matching Elite program companies’ requests for private equity and private debt with professional investors (see here the press release).

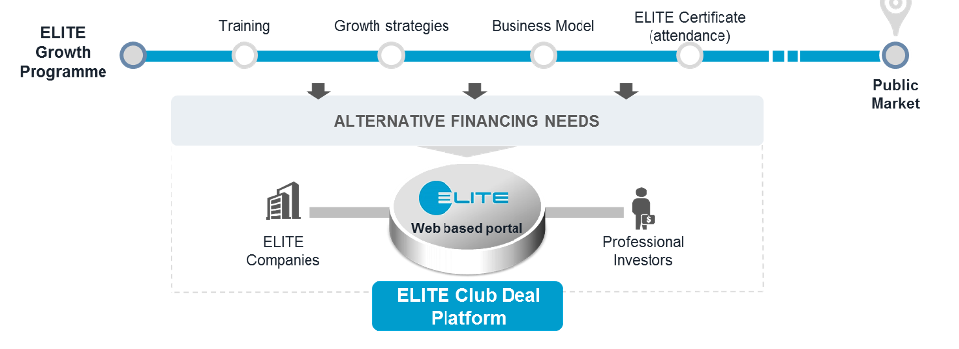

The initiative will help to bridge a funding gap by bringing together professional investors with high growth companies in a secure and efficient environment through an online platform. Pilot phase testing with five European Elite companies will begin shortly, with a full go-live planned for late 2016, subject to regulatory approval.

To access new private growth capital using the platform, be that equity or debt funding, Elite companies will require the support of Elite partners, such as banks, financial advisors, lawyers and auditors to help them prepare and upload required corporate documentation to the platform. All company documentation will be presented in a standardised format, further streamlining the investment process for participants.

Cornerstone investors, including institutional investors, private equity and venture capital firms, will be given the opportunity to access company data and negotiate deal terms as lead investors on the platform in a fully compliant environment. These financings will later be made available to follow-on investors (such as family office, private banking and other professional investors). Agents, typically corporate brokers and banks will facilitate introductions between companies and investors (see here how Elite Club deal will work).

Since 2012, Elite has supported more than 400 fast growing businesses in Italy and UK to prepare and structure for the next stage of growth, guiding them on how best to access the most suitable funding for their needs. Elite Club Deal is the natural next step in the evolution of Elite’s suite of business support services.