Final relaunches on Rcs Mediagroup tener offer came last Friday July 9th late in the evening as both counterparts put forward their last bid for the Corriere della Sera and Gazzetta dello Sport‘s publisher. Deadline for the two tender offers is next July 15th.

Consortium led by private equity firm Investindustrial, acting through International Media Holding, is now offering 1 euro per Rcs share all cash upo from previous offer at 0.80 euros, while Rcs stock closed at 0.852 euros last Friday. This means that if all shares are brought to Investindustrial’s tener offer, the consortium will pay 403.94 million euros.

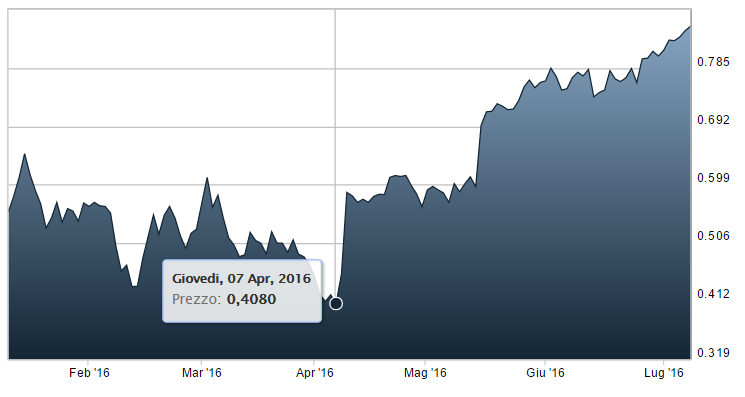

On the other side listed publisher Cairo Communication raised the swap ratio it had offered between Cairo Communication and Rcs to 0.18 Cairo shares for each Rcs share from previous 0.17 ratio (see here a previous post by BeBeez) adding 0.25 euro chas per share. This meaning that the new offer is valueing 1.0242 euros each Rcs share (on the basis of July 9th price for cairo, which closed at 4.38 euros, 4.29%) or 1.0402 euros on the basis of April 7th prices, the day before Cairo launched its tener offer (see here the press release).

If all share are brought to Cairo Communication’s tender offer, the company is to issue about 94 millions of new shares in order to make the promised swap with Rcs shares and will pay 130.4 million euros cash. This money will be provided by Intesa Sanpaolo bank while Cairo’s net financial position will become negative for about 40 millions from actual positive 90 millions. Which is not something the market has priced already.