Tender offer on Milan-listed RCS Mediagroup spa‘s ordinary shares launched by Cairo Communication (listed in turn at the Milan Stock Exchange) started yesterday and will end next July 8th. Next June 20th then will start the competitor tender offerlaunched by a consortium made by private equity firm Investindustrial, Mediobanca, Italy’s entrepreneur Diego Della Valle (founder of Tod’s casualwear shoes), Pirelli and UnipolSai. This second tender offer will end on July 15th.

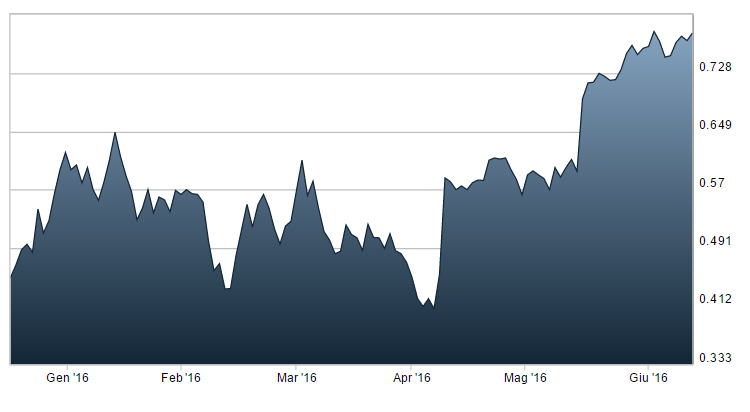

The tender offer by Mr. Urbano Cairo (founder of Cairo Communication) consists in a swap between Cairo Communication stocks and RCS stocks (0.12 Cairo’s stocks for every RCS tendered stock), which means a price of about 0.54 euros per RCS share, after RCS shares had reached 78.3 cents yesterday in Milan. The tender offer prospectus published last May explains that the tender offer will succeed if Caito Communication will reach 50% plus one share of RCS capital but even a 35% stake plus one share might be accepted. Cairo Communications owns a 4.6% stake in RCS at the moment.

On the other side, Investindustrial’s managing principal Andrea Bonomi who is leading the competitor consortium is offering 70 cents per RCS share all cash (see here a previous post by BeBeez), which is still lower than the actual market price and means a maximum price of 282.8 million euros. The tender offer prospectus published last June 11th, explains that the consortium aims at owning a 66.67% stake in the company, however it might decide to accept just a 30% stake tendered as that would mean owning about 52% of RCS’s capital. The consortium is actually now owning a 22.6% stake in RCS which will be brought to International Media Holding, a newco which is going to launch the tender offer and which is controlled with a 45% by Investindustrial.

Mr. Cairo says that a merger between Cairo Communication and RCS might be an option if its tender offer is to succed and that might be welcomed by RCS, as the company is still burdened by a 400 million euros debt whilc Cairmo Communciation has more than 100 million euros in cash.

So Mr. Bonomi and his partners decided to raise their stakes and wrote in the prospectus that they might go over the promised 150 million euros capital increase after the tender offer had been succesful, meaning that they might decide to invest more cash in the company in order to make it one of the major international multimedia groups.

In the meantime last Friday June 10th RCS’s board voted against Mr. Cairo’s offer saying that the price is not fair (see here the press release), on expert’s fairness opinion. RCS’s board will vote about Mr. Bonomi’s offer by next Friday June 17th. By the same date Mr. Cairo has time for a relaunch.