Seven years after having acquired a major stake in Italy’s Esaote, one of the world’s leading manufacturer of medical diagnostic systems, Ares Life Sciences is preparing to divest, DealReporter wrote. Rothschild is said to be the mandated advisor for the sale and the preferred option is listing the company on a Stock Exchange. Enterprise value is said to be about 400 million euros.

Ares Life Sciences, a private equity fund focused on scientific and medical sectors owned by Ernesto Bertarelli, acquired a 39.2% stake in November 2009 in a deal that valued the company 280 million euros and that consisted in the reorganization of the company’s shareholders stakes with the previous shareholders who lowered their stakes as follows: Intesa Sanpaolo bank to 19.2%, Equinox Two fund and Mps Venture 2 fund to 13.2% each and Banca Carige to 8.2%, while the management retained the remaining stake (see here the press release). In July 2014 Carige banks sold a 7.4% stake to Ares Life per a 17 million euros price, retaining a 0.77 (see here the press release) while one of the managers sold Ares its 0.8% stake so the fund raised its stake in Esaote to 48% (see Reuters).

Chaired by Paolo Monferino and led by ceo Karl-Heinz Lumpi, Esaote reached 280.1 million euros in revenues in 2015 (from 262.3 millions in 2014), of which 65% from exports, and 37.3 millions in ebitda ebitda (from 30.8 millions) (see here the press release).

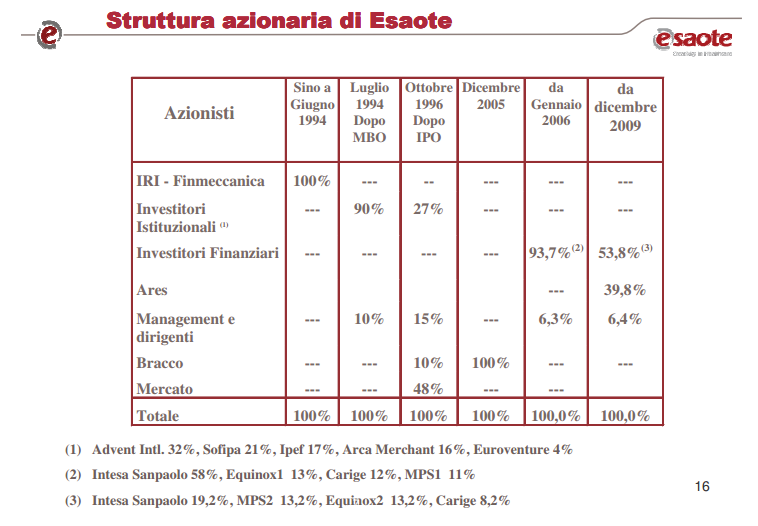

Founded in Genoa in 1982 as a startup inside Ansaldo group, in 1994 Esaote was target of a management buyout which was financed by Advent International (32%), Sofipa (21%), Ipef (17%), Arca Merchant (16%), Euroventure (4%): 22 managers became shareholders for a 10% initial stake while a few months later 53% of Esaote’s employees subscribed a convertible bond. In 1996 Esaote was listed at the Milan Stock Exchange and pharma company Bracco bought a 10% stake. Bracco bought then the entire capital of the company in a tender offer in 2003 for a 5.16 euro per share price.

In 2006 Esaote was a target for a second management which was financed by Intesa Sanpaolo, Mps Ventures, Equinox Two and Banca Carige: a 100 managers took part in the deal. In 2009 Ares Life Science led a new deal (see here Easote’s history told by former chairman Carlo Castellano).