With a one billion euros offer, CVC Capital Partners won auction for control of Italy’s bet and payment services Sisal Group spa, which has been controlled by funds managed by Apax (36.5%), Permira (36.5%) and Clessidra (20%) since 2006. The announcement came yesterday morning and the closing of the deal is expected by next September (see here the press release).

With a one billion euros offer, CVC Capital Partners won auction for control of Italy’s bet and payment services Sisal Group spa, which has been controlled by funds managed by Apax (36.5%), Permira (36.5%) and Clessidra (20%) since 2006. The announcement came yesterday morning and the closing of the deal is expected by next September (see here the press release).

Cvc ‘s bid was preferred to the one by Apollo Global Management who had delivered a binding offer last week to advisors Deutsche Bank and Ubs

(see here a previous post by BeBeez).

Last July MF Milano Finanza had wrote about a potential interest for Sisal by Apollo, Blackstone, Carlyle and Pai (see here a previous post by BeBeez), while last April rumors about Apollo and CVC Capital Partners‘s interest were circulating (see here a previous post by BeBeez), while also Bain Capital was said to be studying the dossier.

CVC, led in Italy by Giampiero Mazza, has a strong track record in the gaming industry through its strategic investments in Sky Bet (UK), Tipico (Germany) as well as its previous investment in William Hill.

Giancarlo Aliberti, partner at Apax Partners, Roberto Biondi, partner at Permira and Simone Cucchetti, partner at Clessidra, said: “Under the ownership of the Apax, Permira and Clessidra funds, Sisal was transformed from a lottery player into a retail conglomerate diversified across payment services, online, video lotteries, sport betting and lotteries. Over this period, profitability more than doubled and the company successfully increased market share in its verticals”.

Founded in 1946, Sisal was the first Italian company to operate in the gaming sector as a Government Licensee. Through its capillary network of 45,000 points of sale, the company offers the public in excess of 500 payment services. Sisal employs about 2000 people.

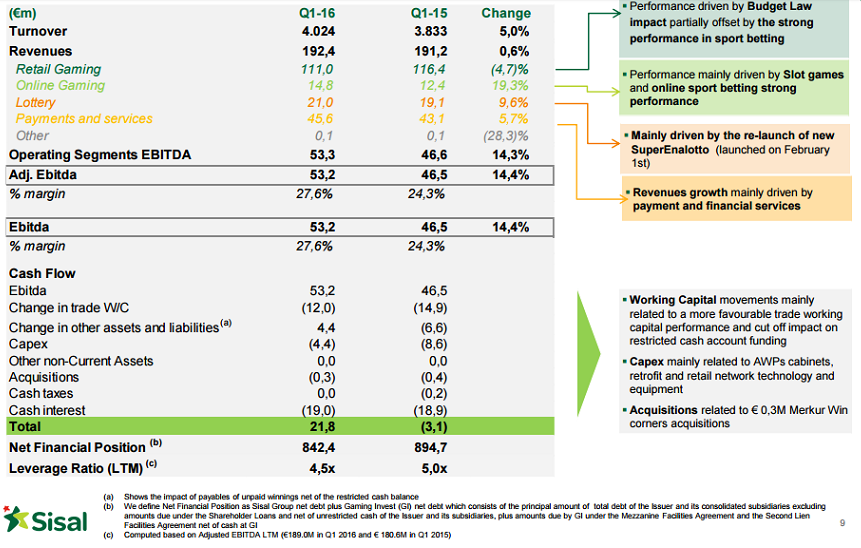

Sisal reached 192.4 million euros in revenues in Q1 2016 (up from 191.2 millions in Q1 2015), thanks to a total turnover of 4 billion euros (from 3.8 billions), led by payment services (2.1 billions). Adjusted ebitda was up too at 53.2 million euros (from 46.5 millions) and the group had a positive net result of 2.1 millions (from a 1.2 million euros net loss). As for the net financial debt, its was down to 842 millions from 865 million euros at the end of 2015, but it was 939.7 millions (from 957.4 millions) when also Gaming Invest’s shareholders loan is counted.

Sisal reached 787 million euros in consolidated revenues in 2015 down from 821 millions in 2014 (see here Sisal’s FY 2015 statements),the adjusted ebitda dropped too to 182.3 millions (from 188.8 millions) and FY 2015 closed with a 39.7 million euros net loss (from just minus one million in 2014).

The 2006’s deal had been conducted on a 1.12 billion euros enterprise value basis (see here Private Equity Monitor) or 14.8x 2005’s ebitda which had been 81,8 million euros after 197 millions in revenues.

CVC was advised by Morgan Stanley, M&A, Bain and Company and AT Kearney on Commercial DD, PwC on Transaction Support, Latham and Watkins on Legal and Facchini Rossi e Soci on Tax, while the sellers were advised by Deutsche Bank, UBS, Legance, Maisto e Associati and PricewaterhouseCoopers. Morgan Stanley, Credit Suisse and Unicredit provided committed debt financing to support the transaction.