Kkr’s turnaround operator Pillarstone Italy, Italy’s listed shipping company Premuda and its three major lender banks (Intesa Sanpaolo, Unicredit and Banca Carige) have finally come to an agreement so the banks will sell Pillarstone their bad loans to Premuda in exchange of asset backed notes representative of part of those credits. At the same time Pillarstone will inject new equity in the shipping company in order to finance the relaunch of the business (see here a previous post by BeBeez).

The deal will also include the sale to Pillarstone of another loan issued by another bank to a company connected to Premuda (Four Jolly).

Premuda’s press release says that thanks to the transfer of loans to Pillarstone, the private equity operator will become the major lender for Premuda and will be entitled to partecipate to meetings with other lenders and push forward a final agreement with all the lenders about a debt restructuring agreement among the Italian Bankrupcty Law framework of art. 67.

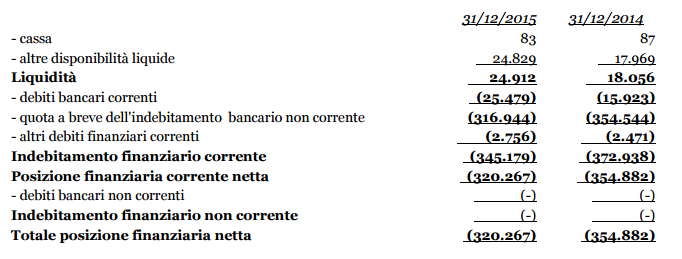

Premuda suffered a consolidated loss of 81.4 million euros in 205, after 24.3 millions in amortization, 18 millions in ships devaulations, 20.5 millions in losses from ships sales, 1.5 millions in revaluations and 4.5 millions in exchange rate losses. Year 2014 also had seen a net loss of 41.8 millions for Premuda. As far as the net financial debt is concerned, the Italian shipping company closed year 2015 with 320.3 million euro down from 354.9 millions in 2014, while Premuda reached 59,8 milllions in revenues (from 68.4 millions) and -63.7 millions in ebit (from -21.5 millions).

Premud’s press release states clearly then the company is seen to perform badly also in 2016 and that future perspectives for the group are linked to an agreement with lender banks for a debt restructuring.

With this deal Banca Carige too, after Intesa Sanpaolo and Unicredit, enters Pillarstone Italy’s platform for turnaround of distressed companies. Intesa Sanpaolo and Unicredit had already transferred to Pillarstone Italy their loans issued to Burgo, Lediberg, Manucor, Alfa Park, and Cuki in exchange of securitized notes while Pillarstone has taken the governance of those companies and will support the relaunch of their business.