Last March 20th a 90-days lock-up period expired for Moleskine’s shareholders Syntegra Capital Partners and Index Ventures Growth. The lock-up period started last November when the two private equity funds, through their contolled companies Appunti sarl and Pentavest sarl, sold on the market part of the their stakes in the Milan-listed group producing notebooks, diaries, journals, bags, writing instruments and reading accessories (see here a previous post by BeBeez).

The two funds had listed the company in 2013 (see here a previous post by BeBeez) and had invested in Moleskine back in 2006. Syntegra and Index sold a 7% stake together last Novembre so Appunti remained with a 36.69% stake while Index Ventures remained with 6.31% (see here Moleskine’s major shareholders).

The two funds were expected to be go on selling their remaining stakes on the market in the coming months as CVC Capital Partners had done with its stake in the business information group Cerved (see here a previous post by BeBeez). On the contrary yesterday Il Sole 24 Ore newspaper wrote about a possible decision by Syntegra and Index to sell their stakes in a unique step to another privatre equity fund. If that happens, the law would aske the newcomer to launch a tender offer on all Moleskine shares.

Rumors are the Triton Capital might be interested in the deal, while sometime ago Permira and Blackstone were said to have looked at the deal. Moleskine stock close at 1.955 euro per share yeaterday on the Italian Stock Exchange (+0,1%) with a 411.16 million euros market cap.

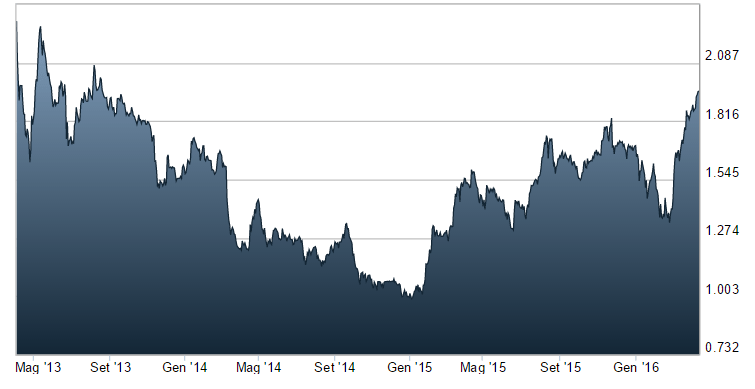

The company had been priced 2.3 euro per share in ipo with a 490 million euros market cap. From then on the stock never touched again that price and on the contrary reached a minimum at 1 euro per share on december 22nd 2014. From that moment the negative trend had inverted and the stock had a very good perfromance.

Moleskine reached 128.13 million euros in net revenues in 2015 (from 98.67 millions in 2014) with 42.3 millions in ebitda (from 33.7 millions) and a positive net financial position of 14 millions (from a negative net financial position of 4.6 millions). In a press release about 2015 financial results, “the company is pleased to reiterate guidance for full year 2016: revenues of €148-153 million and ebitda of € 46-48 million at current exchange rates”.