2015 has been quite a year for private equity and venture capital sector activity in italy. Record levels had been reached by funds raised, investments and divestements, the Italian Association for Private Equity, Venture Capital and Private Debt (Aifi) said last Wednesday March 16th (download here Aifi’s report and here a previous post by BeBeez on 2014 data).

2015 has been quite a year for private equity and venture capital sector activity in italy. Record levels had been reached by funds raised, investments and divestements, the Italian Association for Private Equity, Venture Capital and Private Debt (Aifi) said last Wednesday March 16th (download here Aifi’s report and here a previous post by BeBeez on 2014 data).

Data (processed together with by PwC Transaction Services) were presented by Aifi’s chairman Innocenzo Cipolletta and managing director Anna Gervasoni at a conference in Milan.

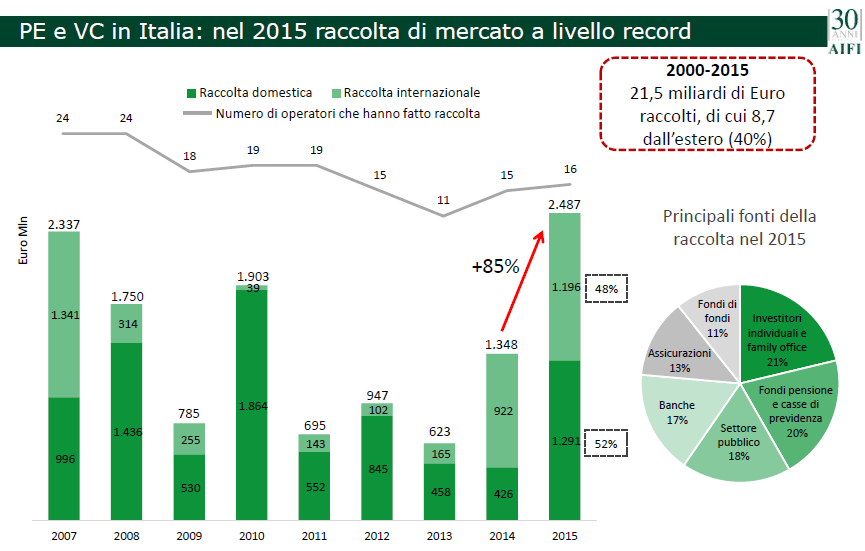

Fundraising recorded a big jump last year (+84.5%) with 2.487 billion euros raised from 1.348 billions in 2014, thanks to 16 funds announcing a closing (from 15 funds in 2014). However pension funds and insurance companies still lag behind as investors.

In 30 years private equity and venture capital funds targeting Italy have been raising almost 40 billion euros, of which 21.5 billions concentrated from 2000 to 2015, Aifi said as the Association celebrates its 30th birthday this year. About 8.7 billions or 40% of the total raised in the last 15 years came from international investors and this stake has been growing fast in the last two years.

In 30 years private equity and venture capital funds targeting Italy have been raising almost 40 billion euros, of which 21.5 billions concentrated from 2000 to 2015, Aifi said as the Association celebrates its 30th birthday this year. About 8.7 billions or 40% of the total raised in the last 15 years came from international investors and this stake has been growing fast in the last two years.

Even if fundraising is growing well in italy, a comparrison with other EU countries shows that there is still a significant gap to cover on this issue: in the 29 years ending in 2014 funds targeting Spain raised 42 billion euros versus 37 billions raised for Italy, while funds got 65 billions for Germany, 125 billions for France and 338 billions for the United Kingdom.

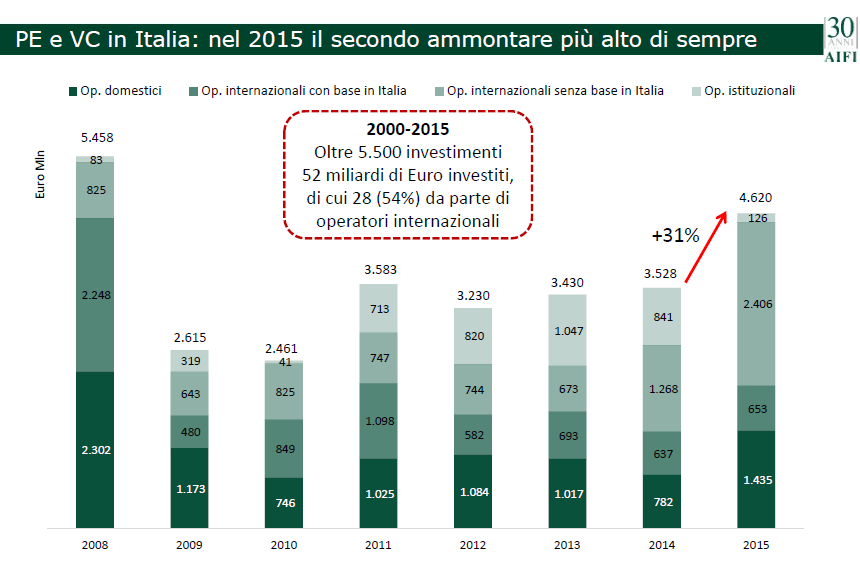

A huge growth was seen on the investment side too with a total of 4.62 billion euros invested (+31% from 2014) in 342 deals (+10%). As for the invested value, this was the second highest level reached in a year Aifi said, after the record at 5.458 billion euros in 2008. Of the total invested, about 66% was by international funds.

Buyout deals represented the biggest stake as for the volume (3.255 billions, +49.2%), with a growing numer of deals (101, +11%). 2015 was a good year for early stage activity too with 122 deal and 74 million euros invested (from 106 deals and 43 million in 2014). Expansion capital activity was instead down with jus 81 deals and 333 million euros invested (from 1901 deals and 1.179 billions).

From 1986 to 2015 private equity funds have been investing about 59 billion euros in Italy spread out on 8.200 deals. The biggest activity was concentrated from year 2000: since that year fund have been investing 52 billion euros in 5.500 deals. About 28 billions came from insternational investors, while 1.8 billions were focused on early stage deals related to 1,372 venture-backed start-up. Comparrison to other EU countries is still not favourable to Italy on this issue too: between 1986 and 2014 private equity and venture capital funds invested 54 billion euros in Italy which is more than the 41 billions invested by funds in Spain, but less than the 81 billions invested in germany, the 121 billions invested in France and the 327 billions invested in United Kingdom.

Finally, on the divestment side private equity and venture capital funds recorded a 10.3% growth in value to 2.9 billion euros (178 deals in line with 2014) above all as secondary buyouts.