Leading Italian temporary employment agency OpenjobMetis expects to list at the Italian Stock Exchange next December 3rd. The move was announced last June (see a previous post by BeBeez).

Leading Italian temporary employment agency OpenjobMetis expects to list at the Italian Stock Exchange next December 3rd. The move was announced last June (see a previous post by BeBeez).

The company actually launched the global offer of its ordinary shares last November 20th and the offer will close on November 30th (see here the press release).

“Proceeds from the ipo will be used to finance the future company growth both by internal lines and through m&a deals”, Openjobmetis’s ceo Rosario Rasizza said last Friday during a press conference in Milan.

“Today we rank as the fifth employment temporary agency in Italy on revenue basis after four big international players. We are the only Italian independent big player in a market where there are other 99 players with 58 of them having revenues of less than 50 million euros”, Mr. Rasizza added.

Openjob is now controlled by Wise Equity II fund manged by Italy’s private equity firm Wise sgr (67%), with chairman Marco Vittorelli (Metis’s founder) and its family (through OmniaFin spa), Mr. Rasizza (Openjob’s founder) and the management (through MTI Investimenti spa) owning the rest of the capital. Wise Equity II fund acquired an 87.5% stake in Openjob in 2003 and since then the company started an m&a campaign. It acquired Pianeta Lavoro, In Time, Quandoccorre Interinale and Just On Business. In 2011 Openjob and Metis merged and the new entity acquired Corium in 2013,

Openjobmetis’s global offering for sale and subscription (see here the Prospectus and here the Registration document) refers to a maximum 5,000,125 shares (equal to the 36.5% of the share capital of the issuer), of which a maximum 2,900,000 newly issued shares are originated by a capital increase and a maximum 2,100,125 shares offered for sale by the actual shareholders.

The global offering includes a public offering of a minimum of 500,125 shares, equal to approximately 10% of the shares object of the global offering to the general public in Italy and to the employees; and an institutional offering of up to 4,500,000 shares, equal to approximately 90% of the offered shares reserved to Institutional investors in Italy and abroad.

The indicative value range of the equity value of the company (prior to the capital increase) was set to be between 64.9 and 75,7 million euros equal to a 6-7 euro price range per share. This means that Openjobmetis expects to raise from 30 to 35 million euros from ipo of which between 17.4 an 20.3 millions coming from the capital increase.

Wise Equity II fund will reduce its stake in the company to 40.95% (or 35.5% after the possible exercise of the greenshoe option) while the Vittorelli family will own a 17.8% stake and the management a 4.8%.

A Sicav-Sif managed by Quaestio Capital Management sgr will subscribe about 25% of the global offering. “The fund is long term investor and committed itselft to subscribe a 9% stake in Openjobmetis shareholders capital at whatever price in the 6-7 euro range”, Mr. Rasizza said.

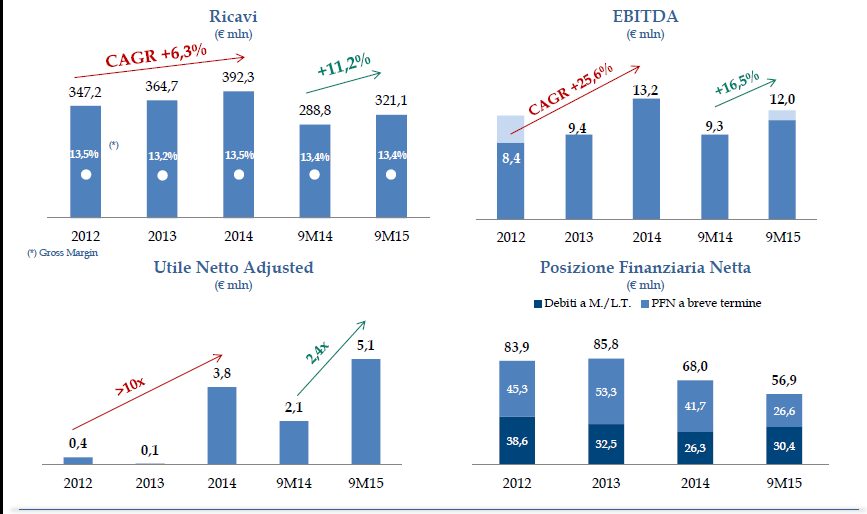

«If you invest in Openjobmetis you bet on Italy’s economic recovery”, Mr. Rasizza concluded as ” demand for temporary jobs is strictly connected to Gdp growth in Italy. Our 9 months’ revenues were up 11.2% at 321.1 million euros and our ebitda was up 16.5% tp 12 milions”. Openjobmetis reached 392.3 million euros in revenues in 2014 with 13.2 millions in ebitda and a net financial debt of 68 millions (which was down to 56.9 millions at the end of last September).