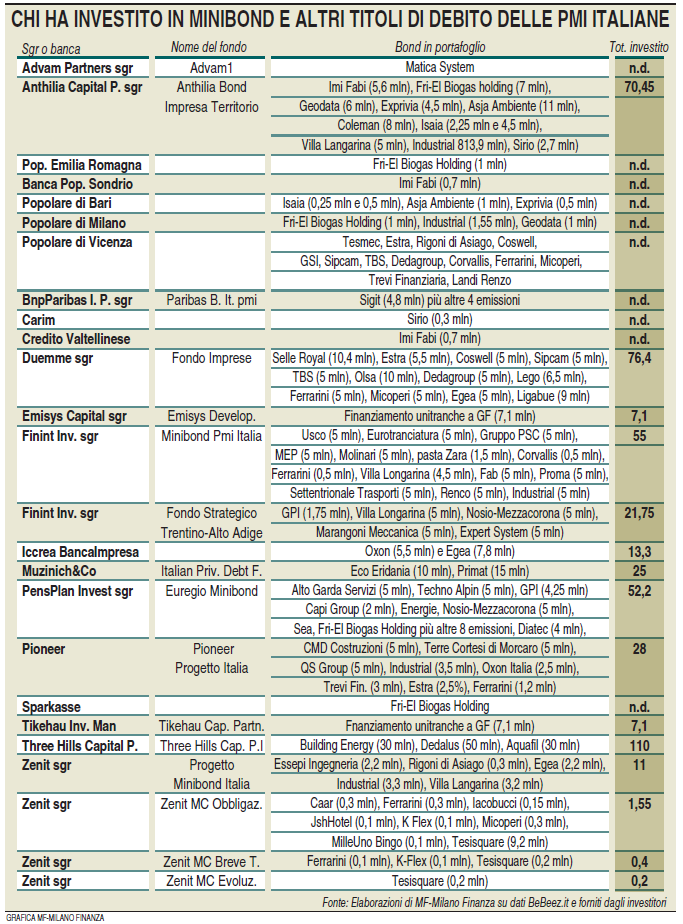

About 30 private debt funds focused on Italian small&medium enterprises’ debt have been launched in the last couple of years but just ten are actually working and had invested sligthly more than 300 million euros. Figures emerged from a survey conducted by MF-Milano Finanza, using BeBeez‘s database too.

About 30 private debt funds focused on Italian small&medium enterprises’ debt have been launched in the last couple of years but just ten are actually working and had invested sligthly more than 300 million euros. Figures emerged from a survey conducted by MF-Milano Finanza, using BeBeez‘s database too.

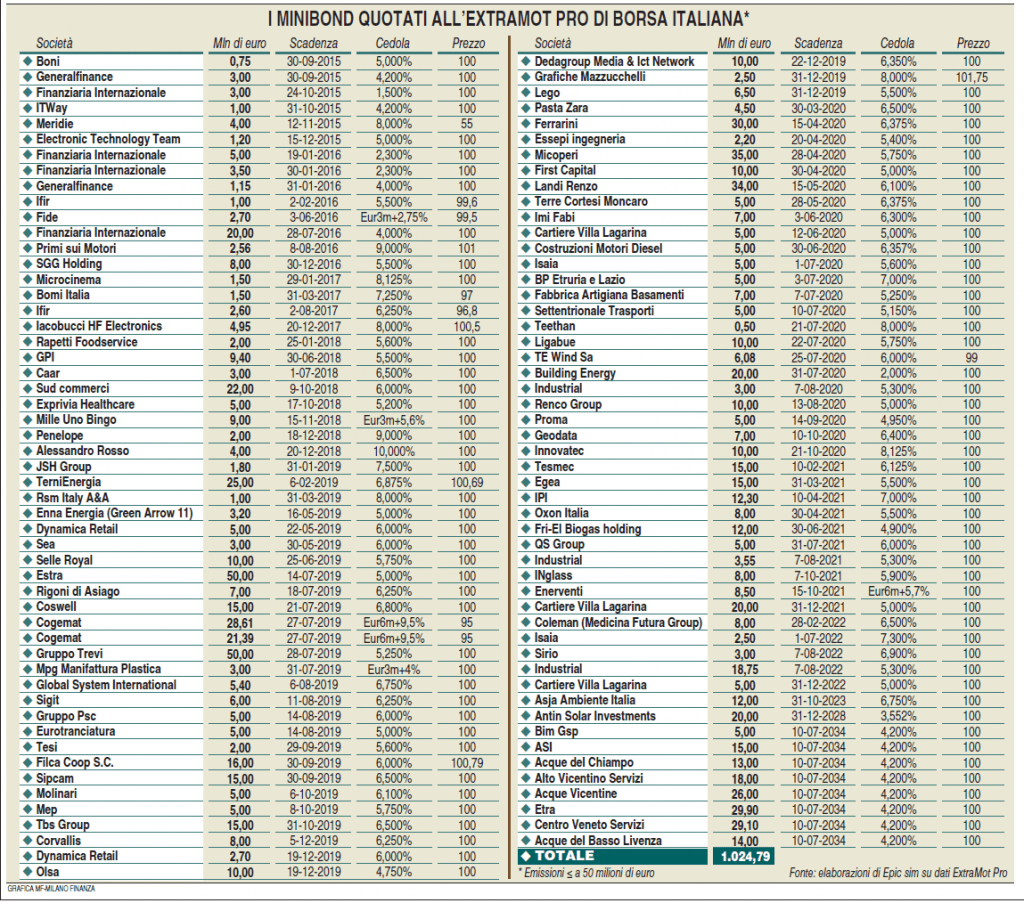

The majority of these bonds have been listed on Borsa Italiana’s ExtraMot Pro market that counted 128 corporate bond issues for a total value of more than 5.2 billion euros at the end of last July. Of the total, 50 million euros maximum size bonds (so called minibonds) were 103 for a total value of more than one billion euros, Epic sim calculated,

This is a very good result if you think that some other foreign experiments were not so successful. As a recent study by Italian local ratging agency Crif Ratings stresses, the German Mittelstandbond (M-bond) market stopped its activity last Spring after 24 issuers defaulted on the coupon payments in the last few months with retail investors that had been significantly hurt (the italian and Spanish minibond markets do not allow retail investors to buy any financial instrument on the platform instead). Now all attention is on the first M-bonds maturing at the end of the month,

German defaults happened even if the majority of the 169 listed issues for a total value of about 10 billion euros have a credit rating issued by one of the four local agencies or by one of the three big international agencies. The rating is not compelling for listing the bonds on the market but this is considered a good practice.

In Spain, all minibonds listed on the Mercado Alternativo de Renta Fija (Marf) do have a rating as this is a compelling rule by the Spanish law. No defaults have been recorded on the Spanish market till now, however this is a very small market with about just one billion euros listed minibonds, due to the fact that listing rules are rather too strict for allowing the market to take off, Crif says. On the contrary in Italy 60% of the listed minibond issues do not have any rating.

The Italian ExtraMot Pro market has been active for more than two years now and new issues come out at a constant pace. However it is still to small if you think of the hundreds of thousand of Italian SMEs that might have potential for issuing bonds. In the next few months some other funds are expected to enter the game as the private debt fund of funds launched by Fondo Italiano di Investimento already committed for 200 million euros to 8 private debt funds and that other dossiers are on the board’s desk.

Last April Fondo Italiano announced its second closing for the Italian private debt fund of funds which raised other 45 million euros on top of the 250 millions Cassa Depositi e Prestiti had committed in September 2014 for a total dry powder then of 295 million euros. Committements by the managing company chaired by Innocenzo Cipolletta and led by ceo Gabriele Cappellini have been signed in two tranche in April and July to the following funds: Equita Private Debt (managed by Lemanik and advised by Equita Sim), Italian Private Debt Fund (Muzinich&Co), Italian Hybrid Capital Fund (RiverRock European Capital Partners), Wise Private Debt (Wise sgr), Antares AZ1 (gestito da Futurimpresa sgr), Fondo di Debito per lo Sviluppo Industriale (Private Equity Partners sgr), Impresa Italia (Riello Investimenti Partners sgr) and Ver Capital Credit Partner Italia V (Ver Capital sgr).

The majority of these funds are still to start working while the most active funds are the ones managed by Duemme sgr (Banca Esperia) with 76-4 million euros invested, by Anthilia Capital Partners sgr (70.45 millions), by Finint Investments sgr (55 millions) and by PensPlan Invest sgr (52.5 millions). Funds managed by Muzinich, Pioneer Im, Fondo Strategico del Trentino Alto-Adige and Zenit sgr follow.

Funds by Emisys Development, Tikehau Capital, Muzinich and Three Hills subscribed private debt instruments issued by Italian SMEs using the same approach of private equity funds’ both in the due diligence and in the management of their investment which is going to be quite mmore active than the one adopted by a lending bank of by a typical minibond fund.

As for banks subscribing minibonds, Popolare di Vicenza, Popolare di Bari,Popolare di Milano and Iccrea BancaImpresa are the more active institues. Pop Vicenza has been arranger and lead manager for many issues and is committed to keep at least a 5% of each issue on its books: the bank has set 250 million euros aside for investments in minibonds. More over also some of the banks who have subscribed the minibond fund managed by Anthilia Capital Partners sgr (Banca Popolare dell’Emilia Romagna, Banca Popolare di Milano, Banca Popolare di Sondrio, Credito Valtellinese, Banca Carige, Banca Carim and Banca Etruria) have subscribed some minibonds already. The agreement with the managing company is actually that each originator bank will be co-invest with the fund for at least a 10% of the value of the minibond issue it has helped to structure.