The period May-July 2015 has really been prolific for the Italian socalled minibond market or SMEs’ bond market and activity never stopped not even during August as 7 other issuers came to the market: General Finance (commercial paper), Building Energy, QS Group, Cartiere Villa Longarina, Sirio, Industrial and Renco.

The period May-July 2015 has really been prolific for the Italian socalled minibond market or SMEs’ bond market and activity never stopped not even during August as 7 other issuers came to the market: General Finance (commercial paper), Building Energy, QS Group, Cartiere Villa Longarina, Sirio, Industrial and Renco.

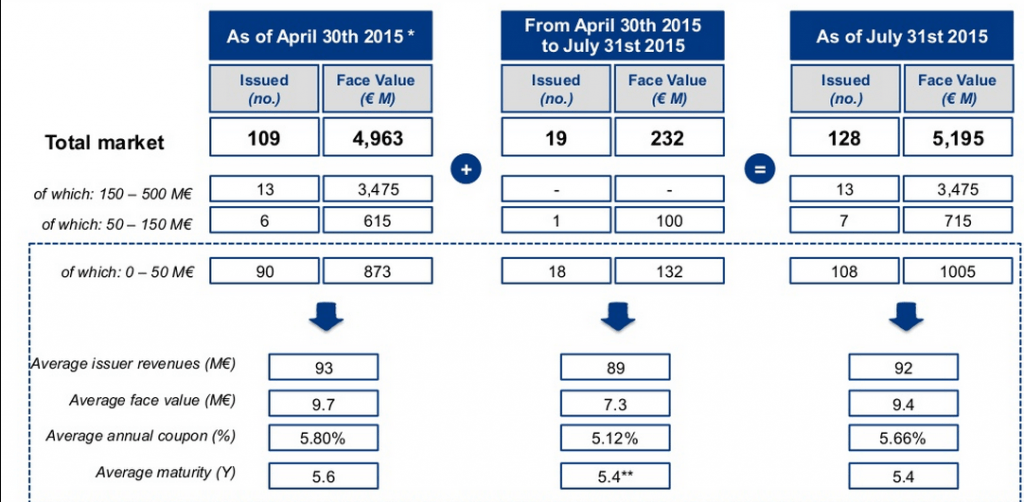

A snapshot of the Italian minibond market in the first seven months of 2015 has been drawn in the last Minibond scorecard report by MinibondItaly.it in collaboration with Epic sim. As July 31st on Borsa Italiana’s ExtraMot Pro market there were 128 listed bonds for a total value of approximately 5.2 billion euros (+4.7% vs previous quarter) with an increase in the number of bonds below 50 million euros in face value: in fact 18 out of 19 new issues in the period May-July fall into this category and minibonds below 50 million euros in face value represent now 19% of the overall market. The report shows also a decrease of the average maturity and coupon rate, consistently with previous quarter, confirming the market consolidation trend as well as a strong concentration of issues in Northern Italy.

More in detail, minibond below 50 million euros have an average face value of 9.4 millions (compared to 9.7 millions, the average as of April 30st 2015), an average coupon rate of 5.66% (from 5.80%) and an average maturity of 5.4 years (from 5.6 years).

Finally an interest from abroad for the italian minibond market is confirmed as 20% of the total number of accesses to the webportal MiniBondItaly.it came from outside Italy, particularly from Usa, UK, Switzerland and Germany.