Italy’s mid-market private equity firm Progressio sgr bought a majority stake in Giorgetti spa, an iconic high-end furniture designer based in Meda (Milan), Il Messaggero newspaper wrote yesterday.

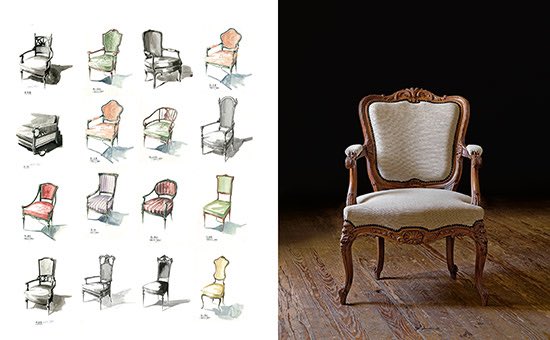

Italy’s mid-market private equity firm Progressio sgr bought a majority stake in Giorgetti spa, an iconic high-end furniture designer based in Meda (Milan), Il Messaggero newspaper wrote yesterday.

Progressio sgr is then sai to have won bids by competitors such as Venice (Palladio Finanziaria), a Chinese investor base in Shanghai and an investors’ club organized by two well-known Italian private equiiters Fabio Sattin (co-founder of Private equity Partners sr together with Giovanni Campolo) and Paolo Colonna (chairman and ceo of Permira e associati spa).

The investors’ club was create last Spring with the aim of building up an Italian design furniture pole and the first investment was made in Gervasoni spa, through the newco Italian Design Brands, and brothers Giovanni and Michele Gervason reinvested with a minority stake in the newco.

Sattin and Colonna’s project has been attracting many other investors since then coming both form the finance and from the industrial sector.

Coming back to Giorgetti, chairman Carlo Giorgetti, 81 years old, and his cousins Pierluigi and Giuseppe, just a littel bit younger than Carlo, had appointed Banca Imi some months ago in order to find the right investor able to continue the company business.

Giorgetti almost reached 40 millioneuros in revenues last year (0f which about 90% from exports) with 5.3 million euros of ebitda. The company has been valued more than 10x itsd eitda for an enterpise value of 55-60 million euros.