Leveraged finance is coming back in Italy too. Banks have actually started to support again buyouts by private equity funds and m&a deals by corporates asking for lower yields and providing a higher percentageof debt over the total deal value.

Leveraged finance is coming back in Italy too. Banks have actually started to support again buyouts by private equity funds and m&a deals by corporates asking for lower yields and providing a higher percentageof debt over the total deal value.

European central Bank Quantitative Easing approach and, before that, market expections of a QE, gave their long waited results also in the private equity secotr even if this is a situation that must be monitored in order to avoid to see again leverage excess as in 2005-2008.

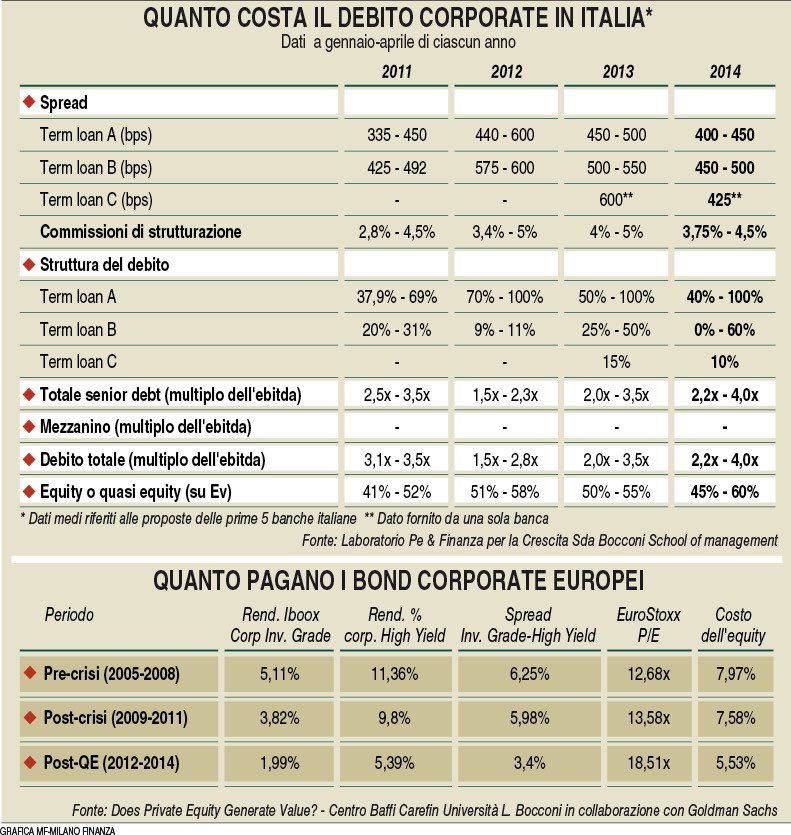

On this issues MF-Milano Finanza provided data from Sda Bocconi School of Management’s Laboratorio Private Equity & Finanza per la Crescita last Saturday.

Valter Conca, director of the Bocconi’s Lab, explained the newspaper that “availability of leverage is gradually coming back: after having reached a minimum in 2012 with a total debt-to-ebitda ratio in a 1.5-2.3x range, leverage grew to a 2-3.5x range and in 2014 to a 2.2-4x range. ANd the trend is growing in thhese first months of 2015”.

Mr. Conca added that “the ratio depends on the deal structure and on the credit standing of the debtor”. Today the minimum average equity-to-debt percentage stands around 45%, down from 50% in 2013.

As far as target companies valutations, enterprise value was about 7-8x ebitda last year, said Conca, stressing that in 2014 the number of deals where EV/ebitda multiple was higher than 8x was up.

A recent study by Stefano Gatti and Carlo Chiarella from Bocconi University’s Centro Baffi Carefin together with Goldman Sachs, conducted on all 31,792 private equity and m&a deals in Europe monitored by Bloomberg from 2005 to 2014 (among which 4,088 private equity deals for a total value of 648.7 billion dollars), showed that in 2012-2014 EV/ebitda multiples were 9.4x on average, after having been just 6.91x in 2009-2011 and 10.42x in 2005-2008. This means that more leverage allows private equity funds to pay more for their targets, but not so much as they used to pay before the financial crisis came.