CVC Capital Partners, through its subsidiary Chopin Holdings sarl, sold a 16.41% stake in the capital of Cerved Information Solutions spa, Italy’s leading business information provider listed on the Italian Stock Exchange, with an accelerated bookbuilding process, cashing in 203.2 million euros (see here the press release).

CVC Capital Partners, through its subsidiary Chopin Holdings sarl, sold a 16.41% stake in the capital of Cerved Information Solutions spa, Italy’s leading business information provider listed on the Italian Stock Exchange, with an accelerated bookbuilding process, cashing in 203.2 million euros (see here the press release).

The deal wad coordinated by JPMorgan as sole bookrunner (the bank was one of the Joint global coordinators and joint bookrunners in Cerved’s global offer in June 2014) withnLatham & Watkins law firm as legal advisor to Chopin.

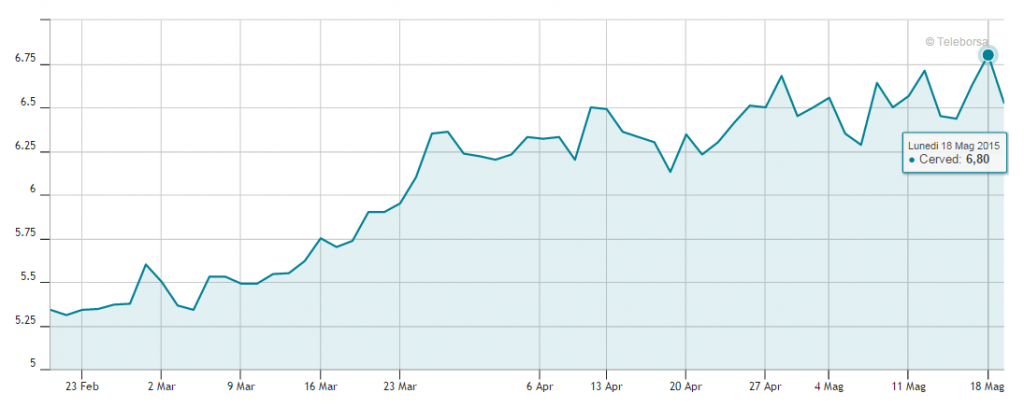

The accelerated bookbuilding took place in just one hour’s time last Monday May 18th after market closed, MF-Milano Finanza writes today. The placement was a success so that CVC opted to sell 32 million shares instead of 29 millions as it had been previously decided. Buyers were open-end investment funds and hedge funds especially based in UK and US.

That was a big result for CVC after in June 2014 it sold in ipo 39 million shares at a price of 5.1 euro each, in the lower end of a price range of 5-5.25 euro per share, for a total consideration of about 198 million euros (see here a previous post by BeBeez).

Cerved’s market capitalization just after the ipo was then 995 million euros and the group had been valued about 10x its ebitda. The accelerated bookbuilding happened instead at a price of 6.35 euro per share, as the stock price is now 33% up from the ipo while the FtseMib index was up just 7% in the same period.

CVC Capital Partners reduced than its stake in Cerved from 55.7% to 39,3% and will sell other stakes in the future in order to divest completely between 2016 and 2017.

Cerved reached 331.3 million euros in revenues in 2014 (from 313.5 millions in 2013), with 160.1 millions of ebitda (from 151.5 millions) and a net financial debt of 487.6 millionsi (from 722.2 millions) (download here the 2014 FY statement).

The group reached 83 million euros in revenues in Q1 2015, with 39.4 millions of ebitda and a net financial debt of 380.9 millions. Cerved’s ceo Gianandrea de Bernardis said that 2015’s ebitda is seen to expected to be in the range of 170-174 millions (see here the press release).