Banca Farmafactoring. a leading provider of credit management and non-recourse factoring services to suppliers to the Italian and Iberian health public sectors, will be sold by paneuropean private equity firm Apax Partners to US private equity firm Centerbrige Partners, that signes now its first italian deal (download here il comunicato stampa).

The deal has been conducted for Apax Partners by the partner Giancarlo Aliberti and for Centerbride Parnters by the principal Luigi Strozzi.

Last September Apax gave mandate to Morgan Stanley in order to evaluate a classic “dual track” process that is a listing of the company on the Stock exchange or a sale to a third party. At the end of last February the bank confirmed that its “shareholders were evaluating strategic alternatives with respect to their holdings” in Banca Farmafactoring’s capital.

Funds advised by Apax Partners (through Farma Holding spa) acquired Farmafactoring in late 2006 when the company was solely operating in Italy. Since that time, the business has grown significantly, notably expanding its services into Spain and Portugal. Banca Farmafactoring obtained a full banking licence in 2013.

More in detail, Banca Farmafactoring manages the collection of its clients’ receivables, allowing them to fully outsource the management of their accounts receivables. In addition, the bank provides non-recourse factoring for clients who choose not to retain them on their own balance sheets. In Italy, it also operates in the retail deposit market.

Banca Farmafactoring reached an intermediation margin of 218 million euros in 2014 up from 108 millions in 2013 and posted e net profit of 124.3 millions (from 48.9 millions). Net dividend to shareholders will top 48.45 millions (from 46,4 millions in 2013).

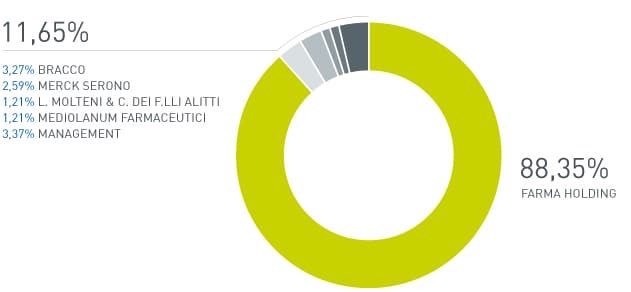

Apax controls the bank with an 88.35% stake, while the management, led by ceo Massimiliano Belingheri, owns a 3.37% stake. The rest of the capital is owned by some pharma industrial groups which are also clients to the bank (Bracco, Mediolanum Farmaceutici e Merck Serono Molteni). The latter will be allowd to decide if keeping theri stakes or selling them all or just a fraction of them, while the manager will reinvest in the deal.

Centerbridge beated competition from other private equity firms such as Blackstone, Cinven, CVC, Lone Star e Permira.

Advisor to Apax for the deal were Morgan Stanley and Mediobanca as for financial matters and studio Gattai Minoli Agostinelli & Partners as for the legal issues. Financial advisors to Centrebridge were Banca Imi andJeffries, while the legal advisor was Santamaria law firm.